PATCHARIN SAENLAKON

By Agatha Malinowski

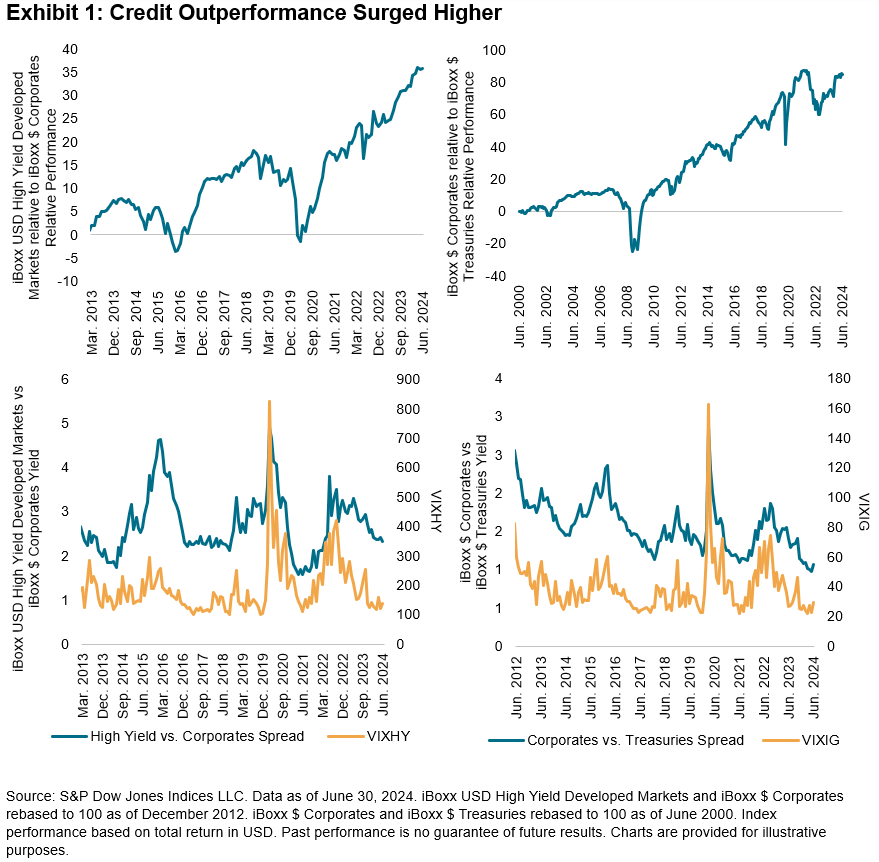

As the bull market in U.S. stocks continues, with the S&P 500® up 18% year-to-date,1 At the same time, we have witnessed an extraordinary period in the bond markets. Historically, credit spreads are low to have led to the outperformance of high yield bonds versus corporate bonds and corporate bonds versus Treasuries. The iBoxx USD High Yield Developed Markets outperformed the iBoxx $ Corporates by 2%, and the iBoxx $ Corporates outperformed the iBoxx $ Treasuries by 1% year-to-date.1 In line with the decline in spreads, credit implied volatility has been muted. The CDX/Cboe NA Investment Grade 1-Month Volatility Index (VIXIG)2 and the CDX/Cboe NA 1-Month High Yield Volatility Index (VIXHY)2 have fallen below the thresholds 30 and 140 respectively.

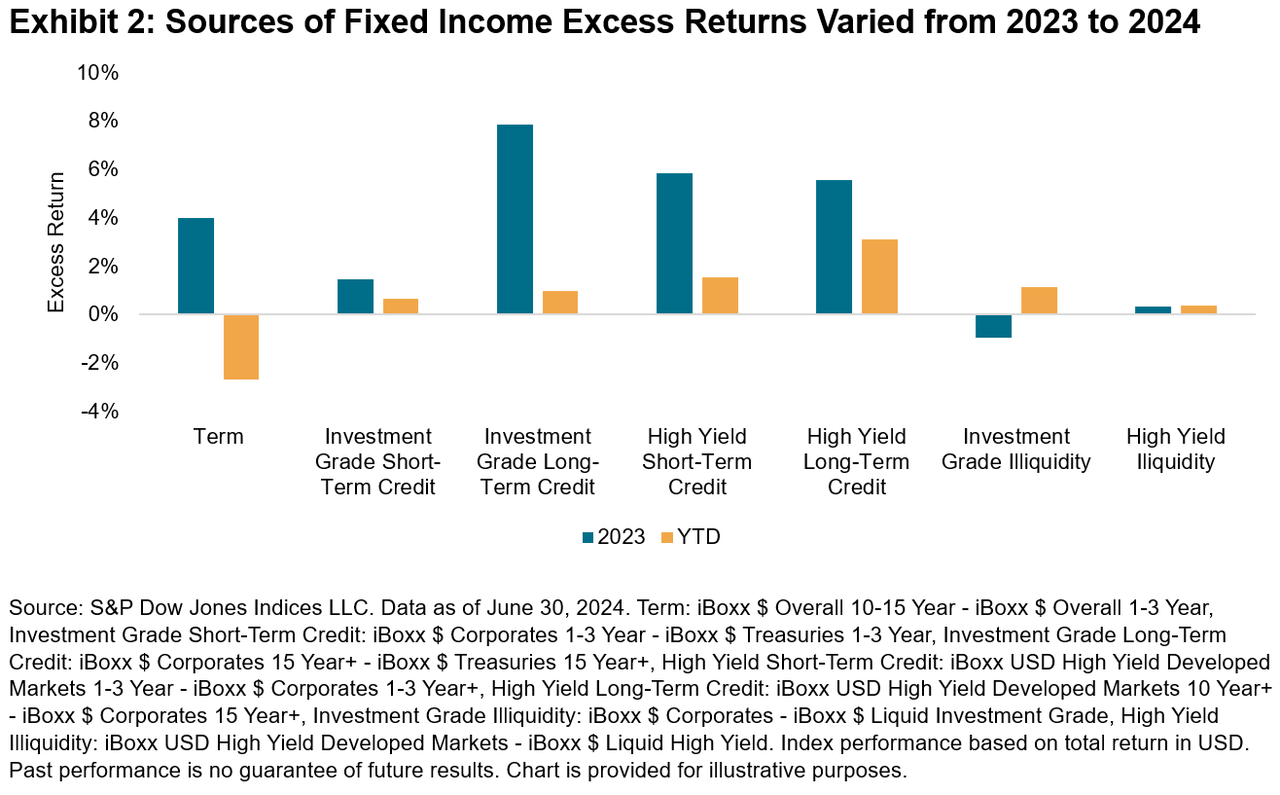

But what do these conditions mean for active fixed income managers? We analyze the traditional sources of excess returnone of Long-term bonds are riskier than short-term bonds, which corresponds to higher interest rate risk, as measured by the yields on longer-term bonds relative to shorter-term ones. Another source of excess return comes from the decline in the credit spectrum toward investment-grade or high-yield corporate bonds. A final key driver of excess return comes from greater exposure to illiquid bonds, as measured by the yield spread between high-yield and investment-grade indices and their liquid counterparts.

As shown in Exhibit 2, a sharp reversal in excess returns from the Term category between 2023 and 2024 means that the shifts toward long duration that would have rewarded managers in 2023 have hurt them so far this year. However, long-term high-yield credit exposures have continued to be accretive, with excess returns outpacing all other reported credit categories. In another reversal from last year, investors may have benefited from taking illiquid exposures in the investment-grade space.

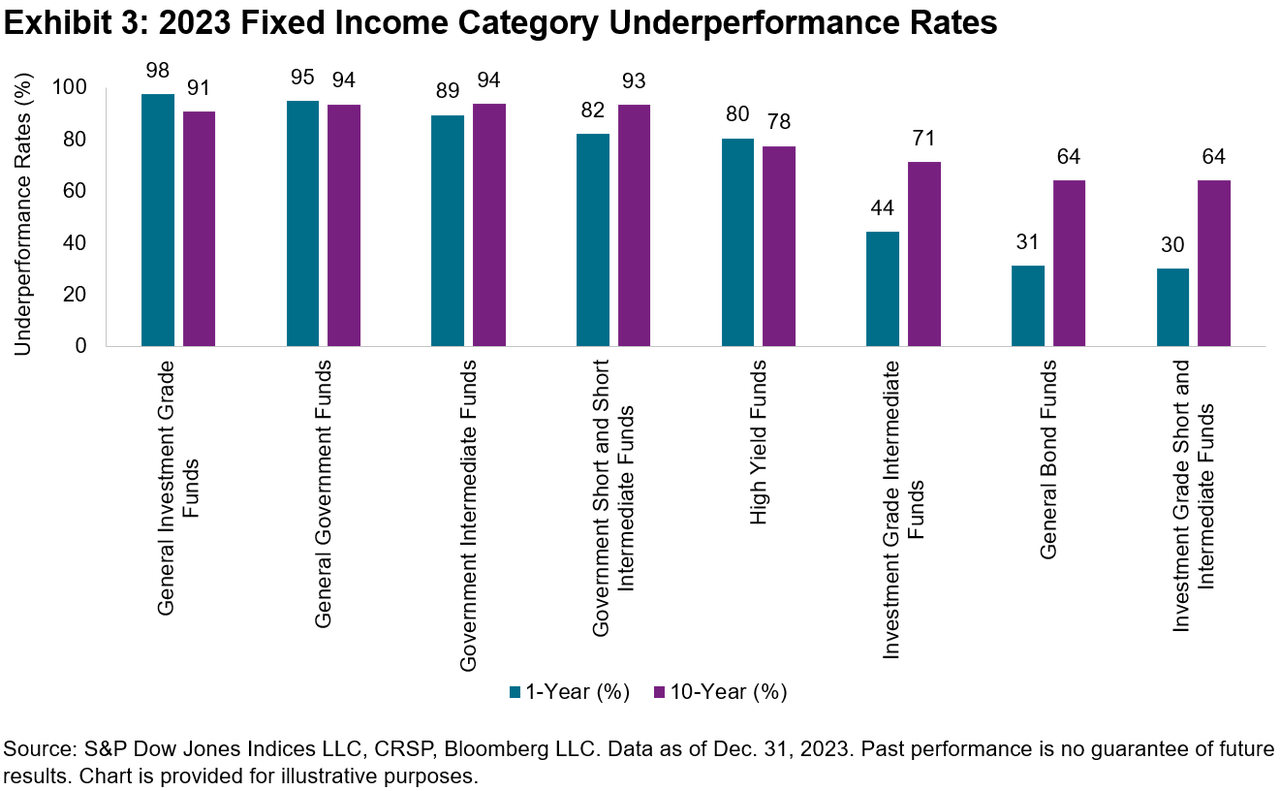

Despite the availability of short-term opportunities to seek excess returns, most active fixed income managers have historically underperformed their benchmarks, particularly over longer horizonsIn 2023, most government funds underperformed across the yield curve. However, the Investment Grade Intermediate and Investment Grade Short-Intermediate fund categories posted majority outperformance, as seen in Chart 3, perhaps benefiting from longer duration inclinations outside the reference.

While interest rate, credit and liquidity conditions for the second half of 2024 remain unknown, we can look to history as a guide. Understanding the sources of excess fixed income returns over time can help explain the likelihood of outperformance in bond markets. For more information on all of our reported fixed income categories, please refer to the SPIVA US 2023 Year-End Dashboard.

1 Data as of July 11, 2024.

2 THE CDX/Cboe NA Investment Grade 1-Month Volatility Index measures market expectations for the magnitude of movements in five-year CDX North American Investment Grade Index spreads over the next month

2 THE CDX/Cboe NA 1-Month High Yield Volatility Index seeks to track market expectations for the magnitude of movements in five-year CDX North American High Yield Index spreads over the next month.

Disclosure: Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information about S&P DJI, please visit S&P Dow Jones IndicesFor full terms of use and information, please visit www.spdji.com/conditions-d-utilisation.

Editor’s Note: The summary bullet points in this article were selected by Seeking Alpha editors.