alfexe/iStock via Getty Images

At first glance, in the universe of countless investment strategies, it seems quite logical to stick to companies that regularly buy back their shares. First of all, it is an approach that is not too complicated and therefore potentially lucrative, as too much sophistication Second, from a fundamental perspective, cash flow spent on share repurchases indicates financial strength and efficiency (i.e., a company has surplus cash that it can use to reward shareholders instead of, say, covering expensive financing expenses because its capital structure is sound), although this assumption has some limitations that we will discuss later. Regardless, a lower share count translates into better per-share metrics, whether earnings or free cash flow, opening the door to improved relative valuation and greater capital appreciation in the future. So, on the surface, it seems that share repurchase-focused portfolios are a treasure trove of pure alpha. However, the reality is far from what one might expect from a share repurchase-focused portfolio. This.

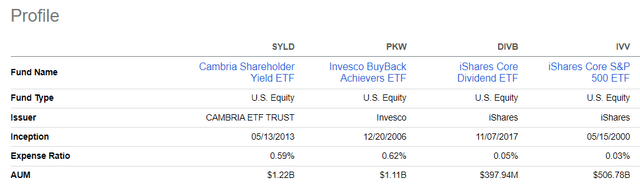

The Invesco BuyBack Achievers ETF (NASDAQ:PKW), a fund that I already have covered nearly two and a half years ago, is a prime example of how a strategy based on share buybacks can disappoint. Over the period January 2007 to June 2024, PKW underperformed the iShares Core S&P 500 ETF (IVV), one of the culprits being its high expense ratio, which currently stands at 62bps. It has also lagged a few peers over shorter periods. And today, we’re going to discuss why a rating upgrade is unnecessary, with a focus on its factor mix juxtaposed with IVV’s.

What is PKW’s strategy?

According to his websitePKW is based on the NASDAQ US BuyBack Achievers™ Index, which

…is designed to track the performance of companies that meet the criteria to be classified as BuyBack Achievers™. The NASDAQ US BuyBack Achievers Index is comprised of U.S. securities issued by companies that have made a net reduction in their shares outstanding of 5% or more over the past 12 months.

Replenishment takes place every January, while rebalancing is more frequent since adjustments are made “quarterly in January, April, July and October.”

It is worth noting that the index does not account for some of the vulnerabilities of a strategy focused on share repurchases. There is no denying that it is nice to see a company repurchasing its shares. However, a few questions arise here. Is this company free cash flow positive? Is the free cash flow sustainable? Is share repurchases a better choice than increasing capital expenditures or engaging in more value-creating M&A activity? Has it seen a rise in debt? Perhaps borrowed funds are being used to reduce the share count. And finally, are the shares being purchased at a comfortable price? Debt-fueled share repurchases executed when a stock is overvalued are clearly value-destroying. So there is a risk that such companies could infiltrate the fund’s portfolio and hurt its returns. This could partly explain PKW’s unattractive performance.

PKW’s promising strategy produces unconvincing results

Despite this attractive strategy, PKW has not managed to consistently outperform IVV in the past. Specifically, launched in December 2006, it underperformed the S&P 500 ETF by 43 bps over the period January 2007-June 2024, although it had some strong years, such as 2008-2011 or 2021-2022, where it consistently outperformed IVV.

| Metric | PKW | IVV |

| Starting balance | $10,000 | $10,000 |

| Final sale | $50,435 | $54,053 |

| TCCA | 9.69% | 10.12% |

| Standard deviation | 17.49% | 15.78% |

| Best year | 45.57% | 32.29% |

| The worst year | -33.38% | -37.02% |

| Maximum draw | -50.29% | -50.79% |

| Sharpe ratio | 0.55 | 0.61 |

| Sortino Report | 0.82 | 0.91 |

| Capture on the rise | 99.32% | 98.45% |

| Downward capture | 100.04% | 96.91% |

Portfolio Visualizer Data

Compared to other funds that focus on share repurchases or shareholder returns (the concept of shareholder returns encompasses share repurchases, dividends, and in some cases debt repayments), PKW’s returns also look unimpressive. Below, I’ve compiled data for the ETF as well as IVV, the Cambria Shareholder Yield ETF (SYLVIE) and the iShares Core Dividend ETF (DIVB). The period has been reduced to December 2017-June 2024, as DIVB has the shortest trading history in the group. It is worth briefly explaining that SYLD is actively managedfavoring

Cash-flowing companies that return their cash to investors through three attributes – dividends, share repurchases and debt repayment – collectively known as shareholder returns.

According to iSharesDIVB is based on the Morningstar US Dividend and Buyback Index.

| Metric | IVV | PKW | SYLVIE | DIVB |

| Starting balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final sale | $23,056 | $19,629 | $21,310 | $20,084 |

| TCCA | 13.53% | 10.79% | 12.18% | 11.17% |

| Standard deviation | 17.52% | 20.61% | 25.14% | 18.14% |

| Best year | 31.25% | 34.09% | 48.30% | 32.73% |

| The worst year | -18.16% | -10.52% | -13.53% | -10.51% |

| Maximum draw | -23.93% | -29.25% | -37.12% | -24.50% |

| Sharpe ratio | 0.69 | 0.5 | 0.5 | 0.56 |

| Sortino Report | 1.06 | 0.76 | 0.77 | 0.85 |

| Capture on the rise | 100.77% | 100.13% | 98.99% | 94.10% |

| Downward capture | 97.08% | 107.33% | 100.32% | 98.31% |

Portfolio Visualizer Data

As can be seen, PKW underperformed all selected ETFs, also posting the highest downside capture ratio (with the US market as a benchmark). This is particularly disappointing, given the differences in expense ratios.

Does PKW have a factor advantage over IVV?

As of July 11, PKW held a portfolio of 199 stocks, with an overlap with IVV of nearly 80%, according to my calculations. At the same time, the companies in PKW’s portfolio weigh only 4.8% in this S&P 500 ETF.

Weight as of July 11 (Created by the author from the funds data)

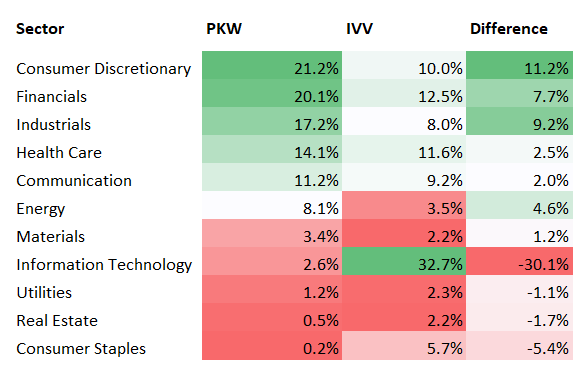

In terms of sectors, the most notable difference is that PKW is significantly underweight in IT. I suspect that one reason for this is the evolution of AI. Specifically, in order not to miss out on this revolutionary theme, technology players have to allocate more funds to research and development activities; they therefore refrain from returning cash to shareholders and, as a result, IT is underrepresented in the buyout index.

Another interesting fact: PKW is much more exposed to financial stocks. This can be partly explained by higher interest rates that have strengthened the bottom line of banks and other institutions, giving them more flexibility in terms of share buybacks and/or dividends. Let’s now take a closer look at the value, growth and quality factors.

Value

Without these multi-trillion dollar flagships, PKW looks much thinner than IVV, with a weighted average market cap of just $79.9 billion as of July 13, compared to $1.06 trillion for the S&P 500 ETF. To provide a bit more color, there are only six mega-caps in PKW’s portfolio, including T-Mobile US (TMUS), its largest holding, which weighs around 5.7%. The fact that PKW has a higher adjusted earnings yield (loss-making companies have been removed) is not a surprise here. At the same time, it is also the consequence of its high exposure to financials, a sector known for its low P/E (a median GAAP P/E of 12.1x at the time of writing).

| Metric | PKW | IVV |

| EY adjusted | 7.06% | 3.68% |

| P/S | 2.98 | 9.1 |

| Quantitative assessment B- or better | 17% | 7.3% |

| Quantitative assessment D+ or worse | 50.6% | 81.8% |

Calculated by the author from Seeking Alpha and ETF data

Growth

As a value-oriented ETF, PKW exhibits, as expected, rather mild growth characteristics, with its WA forecast revenue growth rate being particularly telling.

| Metric | PKW | IVV |

| Fwd Income | 2.95% | 11.89% |

| EPS before | 11.05% | 17.46% |

| Quantitative growth B- or better | 37.9% | 53.1% |

| Quantitative growth D+ or worse | 39.4% | 29.9% |

Calculated by the author from Seeking Alpha and ETF data

The fact that 30% of PKW’s holdings are expected to experience revenue contraction in the future (there are only 10.8% of these companies in the IVV) means that it could become difficult for them to maintain their share buybacks, which may lead to their removal from the index and the portfolio.

Quality

PKW offers a quality mix, with over 93% of its holdings having a quantitative profitability rating of B- or higher. However, IVV is even stronger on this front. Moreover, IVV’s adjusted ROE (neither negative numbers nor three-digit and four-digit numbers were taken into account, as usual) and ROA are higher. Its higher ROA is probably a consequence of its lower exposure to financials.

| Metric | PKW | IVV |

| Adjusted return on equity | 18.3% | 19.9% |

| Return on assets | 8.48% | 14.29% |

| Quantitative profitability B- or better | 93.2% | 95.12% |

| Quantitative profitability D+ or worse | 1.5% | 3.13% |

Calculated by the author from Seeking Alpha and ETF data

What investors think

PKW offers an attractive concept that, unfortunately, has not translated into significant and consistent outperformance in the past. Furthermore, it is an extremely expensive vehicle, with an ER of 62 bps. Such high fees are more common among international ETFs with much more complex strategies or actively managed funds. At the same time, even though it has a value orientation, I believe it does not have a factor advantage over IVV. In this regard, I do not really see a reason why investors should chase redemption stories with this ETF. However, in the absence of a downside catalyst that I would consider strong enough to push PKW’s price significantly lower, I believe it is worth maintaining the Hold rating today.