walk

Antero Resources Company (New York stock market :AR) is an American hydrocarbon company with a market capitalization of approximately $10 billion. The company has recently experienced a recovery, but remains volatile as natural gas prices remain low. Despite this, long-term demand for natural gas, supported by power and LNG production, Antero Resources is a valuable long-term investment.

Natural gas demand

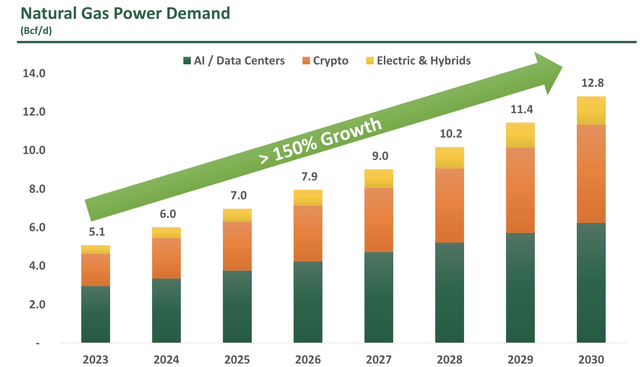

Demand for natural gas is expected to increase as demand for electricity continues to grow.

Antero Resources Investor Presentation

Growth is expected to be strong, driven by AI/data centers and electric and hybrid vehicles. We personally think the cryptocurrency demand forecast is a bit fanatical given the market weakness for the industry in the long term, although that is not the focus of this article. Growth is also expected to be strongly supported by LNG and increased exports to Mexico.

This natural Gas demand, particularly driven by LNG growth, should provide a consistent long-term baseline for prices.

Antero Resources Overview

Antero Resources has a portfolio of assets in inventory to leverage.

Antero Resources Investor Presentation

The company has a portfolio of assets spanning several decades with a low breakeven point. At the same time, the company has an integrated portfolio of intermediate products, which allows it to benefit from strong integration with Henry Hub prices and privileged access to tariffs. The company has low debt and is working to continue to repay it.

However, with free cash flow close to zero, at current low prices, it will take the company some time to pay this amount back. Fortunately, future natural gas prices are recovering, pushing toward $3/mmBTU or even higher. A recovery in the company’s free cash flow could be massive.

Antero Resources Cash Flow Forecast

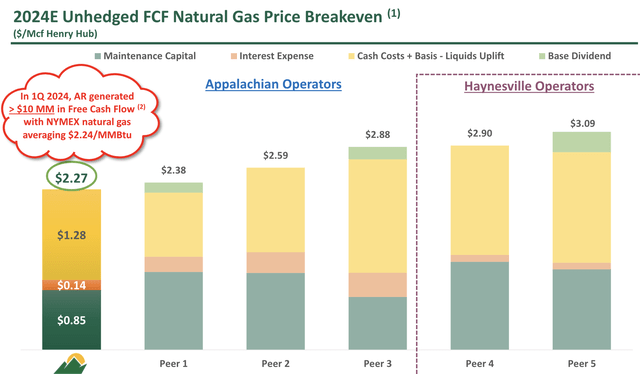

The company is strong in a competitive market, with an incredibly low breakeven point indexed to Henry Hub.

Antero Resources Investor Presentation

However, the company continues to be affected by weak prices. The company’s break-even point is only $2.27, with interest expenses accounting for $0.14 of that amount. The company is working to use FCF to reduce its interest expenses, which will help support long-term break-even rates. However, the company continues to improve its operations.

However, FCF is virtually zero at current prices, and that is something that needs to change in the long term.

Antero Resource Tips

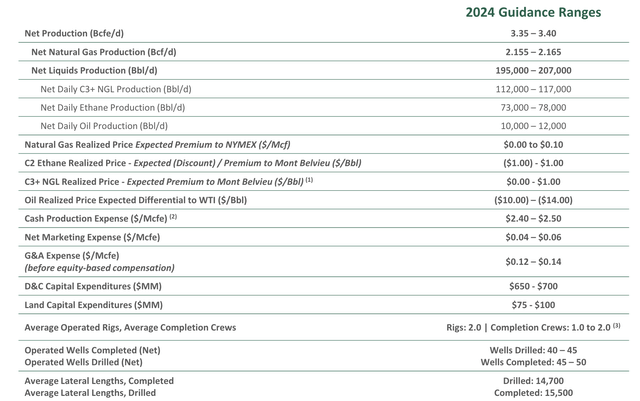

The company’s forecast helps highlight how it is handling the economic slowdown, while focusing on a long-term setup.

Antero Resources Investor Presentation

The company is expected to produce about 2.16 billion cubic feet per day of net natural gas, with total production equivalent to about 50% more. The majority of this production will come from C3+ and ethane production. The company’s midstream network, discussed above, allows it to earn a premium on most of its products, with the exception of oil prices, which represent only a small portion of its portfolio.

The company’s expenses are relatively high, higher than current oil prices, which explains why the company’s number of completion crews remains lower. Wells drilled are also expected to be longer than wells completed. This will allow for increased production if prices recover.

Antero Resources Shareholder Return

Antero Resources is committed to restoring balance sheet health and generating long-term returns for shareholders.

Antero Resources Investor Presentation

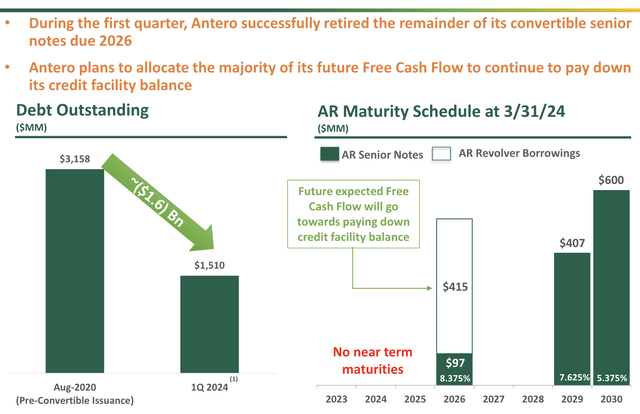

The company has worked hard to improve its balance sheet and has reduced its debt to about $1.5 billion. Compared to a market cap of over $10 billion, this is something the company can comfortably afford. The company plans to repay its $415 million revolver in 2026, which will bring its net debt to $1 billion.

This represents $35 million in interest savings that the company can dedicate to shareholder returns. We are pleased to see the company continue to improve its debt, which will help generate additional shareholder returns. It is worth noting, however, that most of the company’s shareholder returns will not be direct.

Thesis Risk

The biggest risk to our thesis is continued weakness in natural gas prices. The company has adapted its operations to deal with low prices, but there is no guarantee it can cope with them in the long term as it must use its available cash to continue paying down debt. This is a risk worth examining closely.

Conclusion

Antero Resources, like all other natural gas producers in the United States, is in a difficult situation. Natural gas prices are low and producers are struggling to break even. Despite this, the company is well positioned with a reserve life of several decades and a commitment to drilling. The number of wells drilled by the company exceeds the number of wells completed, which is a testament to its long-term outlook.

The company is focused on using free cash flow to repay its manageable debt and has minimal near-term maturities. Given the demand for data centers and LNG, as well as increasing exports to Mexico, we expect natural gas prices to increase. This will increase free cash flow and long-term returns to shareholders, making Antero Resources a valuable investment.

Please feel free to share your thoughts in the comments below.