Megapixel8/iStock via Getty Images

JGLO Strategy

JPMorgan Global Select Equity Exchange Traded Fund (NASDAQ:JGLO) is an actively managed ETF launched on 09/13/2023. It has 74 holdings, a 30-day SEC yield of 1.09% and a total expense ratio of 0.47%.

As described by JPMorgan, JGLO invests in “companies that are attractively valued, have strong free cash flow and the potential for sustained earnings growth” The bottom “Seeks to consistently outperform the MSCI World Index while effectively managing risk across sectors and regions. JGLO invests primarily in developed markets, although it may occasionally select companies in emerging markets. “The Fund may, but does not currently intend to, hedge its currency exposure.” The portfolio turnover rate was 28% over the last financial year. This article will use the MSCI World Index, represented by the iShares MSCI World ETF (URTH).

Wallet

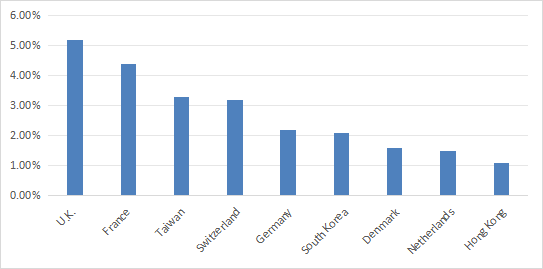

Approximately 92% of the asset value is invested in large and mega-cap companies. The portfolio is overweight in the United States (69.7% versus 71.6% for the benchmark), followed by the United Kingdom (5.2%) and France (4.4%). The overall weight of Taiwan and Hong Kong is 4.4%, meaning that direct exposure to geopolitical and regulatory risks related to China is low. The following chart lists countries with a weight greater than 1%, excluding the United States for readability.

Geographic distribution of JGLO outside the United States (chart: author; data: JPMorgan)

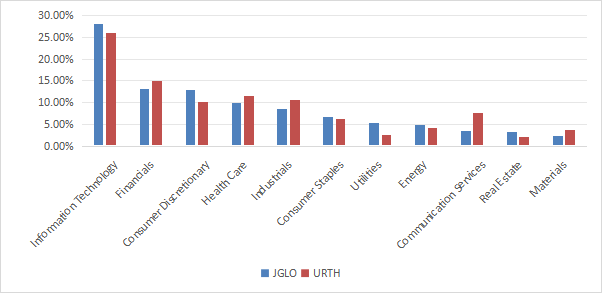

The heaviest sector is technology with 28% of assets. It is followed by financials and consumer discretionary, both close to 13%. The other sectors are below 10%. Compared to the benchmark, JGLO is mainly underweight communication services.

JGLO sectoral distribution (chart: author; data: JPMorgan, iShares)

The top 10 holdings, listed in the following table, represent 40.6% of the asset value. The four largest holdings account for more than 5%. The risks associated with other individual companies are low to moderate.

|

American stock symbol |

Name |

Weight% |

EPS growth (%) over 12 months |

Long-term price-to-earnings ratio |

Price/earnings ratio before |

Yield% |

|

Microsoft Corp. |

7.46% |

25.11 |

39.40 |

38.47 |

0.66 |

|

|

Apple Inc. |

5.92% |

9.26 |

35.39 |

34.47 |

0.44 |

|

|

Amazon.com, Inc. |

5.50% |

763.59 |

54.78 |

42.52 |

0 |

|

|

NVIDIA Corp. |

5.38% |

788.51 |

74.52 |

47.12 |

0.03 |

|

|

Meta Platforms, Inc. |

3.52% |

115.95 |

29.45 |

25.34 |

0.39 |

|

|

Mastercard, Inc. |

3.34% |

25.70 |

34.69 |

30.54 |

0.60 |

|

|

Nestlé SA |

2.55% |

31.09 |

22.26 |

18.98 |

3.13 |

|

|

Shin-Etsu Chemical Co., Ltd. |

2.43% |

100.04 |

23.51 |

N / A |

1.53 |

|

|

LVMH Moët Hennessy – Louis Vuitton SE |

2.33% |

11.34 |

23.55 |

22.89 |

1.81 |

|

|

Munich Life Insurance Company AG |

2.21% |

N / A |

N / A |

10.13 |

3.19 |

*The fund holds shares on the main stock exchange.

Fundamentals

JGLO is slightly more expensive than URTH in terms of valuation ratios and has a higher earnings growth rate as shown in the following table.

|

JGLO |

URTH |

|

|

Course/Benefit |

24.86 |

22.63 |

|

Price/Reservation |

4.32 |

3.29 |

|

Price/Sales |

3.46 |

2.41 |

|

Price/Cash Flow |

16.89 |

15.09 |

|

Profit growth |

26.45% |

22.60% |

|

Sales growth |

9.77% |

9.07% |

|

Cash flow growth |

9.45% |

10.11% |

Source: Fidelity website

Performance

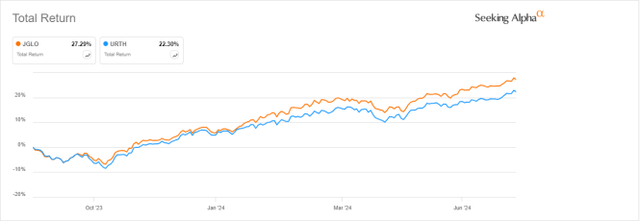

Since its inception 10 months ago, JGLO has achieved its goal of beating the MSCI World Index, with an excess return of 5%. However, the price history is too short to assess the strategy’s long-term potential.

JGLO vs URTH since 09/14/2023 (Looking for Alpha)

Competitors

The following table compares the features of JGLO and five of the most popular global equity ETFs:

- Goldman Sachs ActiveBeta World Low Vol Plus Equity (Glove)

- First Trust Dow Jones Global Select Dividend Index Fund (Discussion group)

- Motley Fool Global Opportunities ETF (TMFG)

- ETF Avantis All Equity Markets (AVERAGE)

- Davis Select Worldwide ETF (DWLD)

|

JGLO |

Glove |

Discussion group |

TMFG |

AVERAGE |

DWLD |

|

|

Creation |

09/13/2023 |

03/15/2022 |

21/11/2007 |

06/17/2014 |

09/27/2022 |

11/01/2017 |

|

Expense ratio |

0.47% |

0.25% |

0.56% |

0.85% |

0.23% |

0.63% |

|

AT M |

$3.48 billion |

$918.54 million |

$526.91 million |

$439.92 million |

$379.45 million |

$311.87 million |

|

Average daily volume |

$12.17 million |

$2.01 million |

$1.51 million |

$430,050,000 |

$1.76 million |

$341.12K |

|

Funds |

74 |

371 |

106 |

42 |

15 |

40 |

|

Top 10 |

40.60% |

15.58% |

17.75% |

40.10% |

95.52% |

49.36% |

|

Turnover |

28.00% |

31.00% |

35.00% |

4.00% |

2.00% |

15.00% |

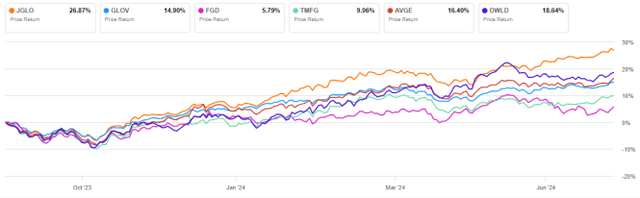

They include all of the United States in their portfolios. JGLO is the largest of these funds in terms of assets under management and the most liquid in terms of dollar volume. Its expense ratio is average. The following chart shows total returns since 09/14/2023. JGLO leads the pack, beating the second-placed fund by 8.2% in 10 months.

JGLO vs. competitors, since 10/25/2017 (Looking for Alpha)

Take away

The JPMorgan Global Select Equity ETF is an actively managed global equity ETF focused on value, free cash flow, and earnings growth. JGLO is overweight U.S. large companies and information technology. Its 10-month track record is too short to evaluate the strategy, but it is promising: it has met its target of beating the MSCI World Index and has also outperformed five of the most popular global equity ETFs.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Be aware of the risks associated with these securities.