Posted today by CEA:

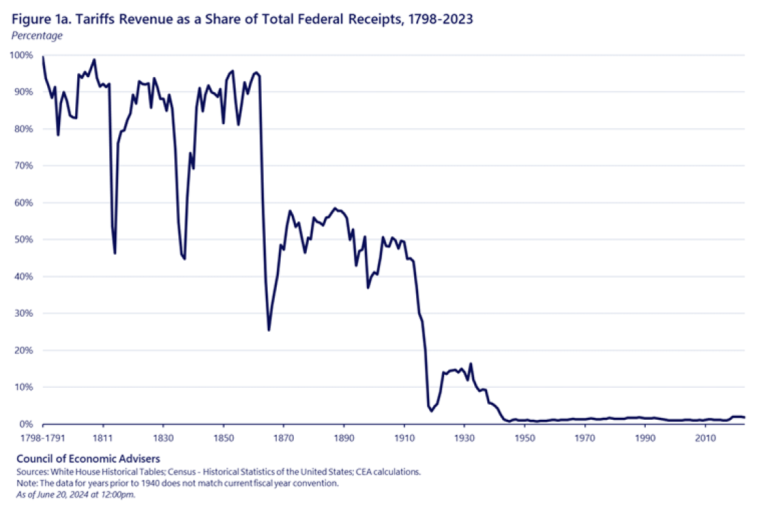

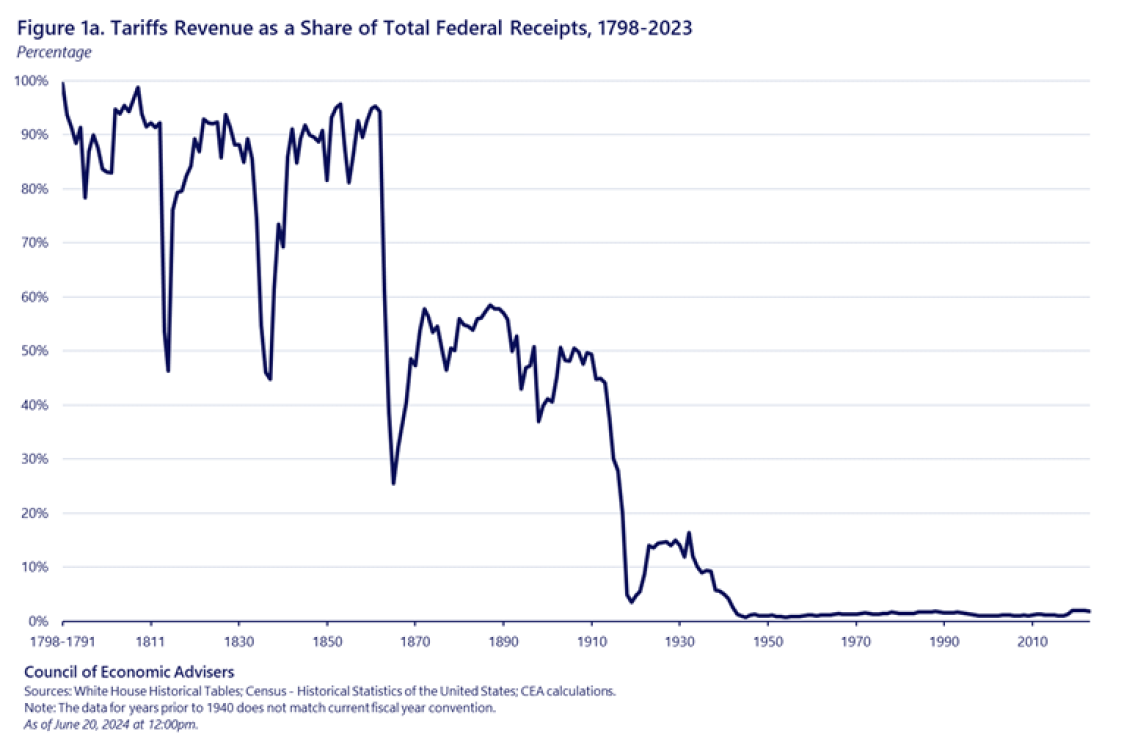

Well, first, a picture illustrating the plausibility:

Let’s move on to the conclusion:

Strategically targeted tariffs are an important tool to protect U.S. economic and international interests. However, the potential for a broad-based tariff to generate significant tax revenue in a modern global economy is limited. Moreover, increased federal reliance on tariff revenues would likely exacerbate long-term trends in income inequality by shifting more of the tax burden onto low-income households. It is also very likely to generate significant negative macroeconomic distortions.

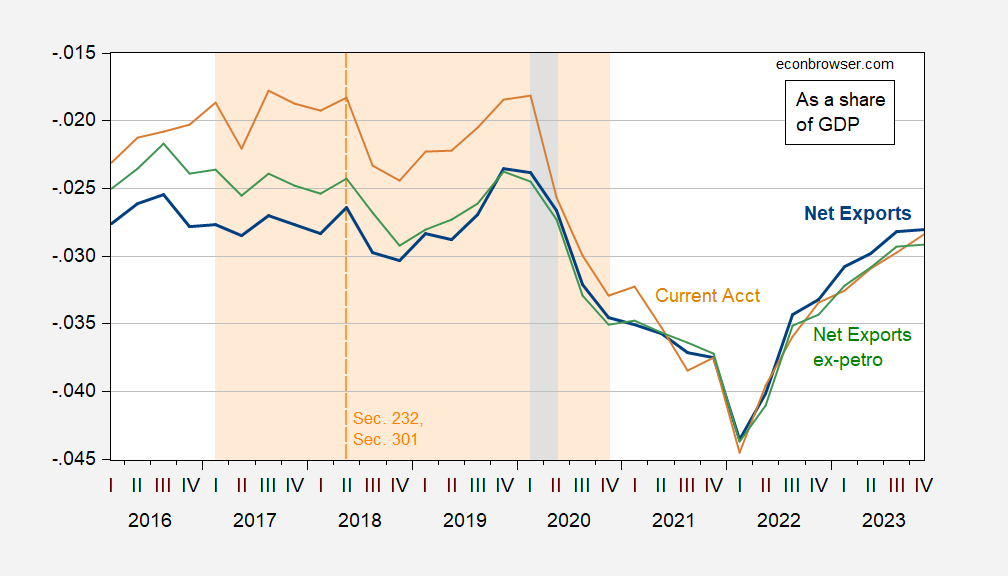

And if you thought tariffs had no effect on the trade deficit under Trump, wait until a 10% tariff comes into effect…

Figure 1: Net exports as a share of GDP (bold blue), non-oil net exports (green), and the current account (beige), all as a share of GDP. The Trump administration shaded the dotted line at the beginning of the Section 232 and 301 measures in orange. NBER-defined recession dates are shaded in gray. Source: BEA, NBER, and author’s calculations.