Visions/iStock via Getty Images

Investment thesis

Match group (NASDAQ:MTCH) has several positive aspects: it is a company with globally recognized applications. It offers a product for which there will probably always be demand. It has good margins and is buying back shares. However, the market is currently giving the company a relatively low valuation, as user numbers have recently fallen and overall EPS growth is in the low single digits. Overall, this is a possible turnaround bet. With surprisingly good Q2 numbers, the stock could surge higher, but in my opinion, it’s a risky bet.

Company presentation

Match Group is a group of well-known online dating apps and operates worldwide. Founded in 1986, the company currently employs around 2,600 people and offers services in around 40 languages. This is a positive aspect because it means that the company is not dependent on a single market. Demographics The trends are rather negative in some countries and better in others, as is economic development. According to the company, the various applications have been downloaded more than 750 million times.

Match Group Investor Relations

The Past: Financial Progress and Trends

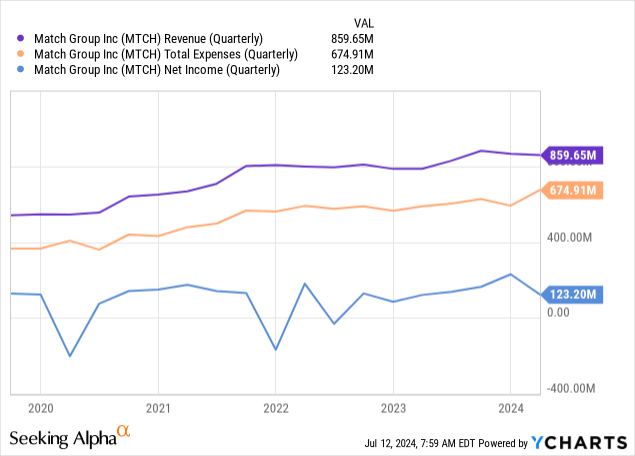

First, a brief look at revenue, expenses, and net income over a longer period. This stock has seen a strong rally during the pandemic, although costs have also increased to a similar extent. Sales have only increased slightly since 2022, and net income has been stagnant for years.

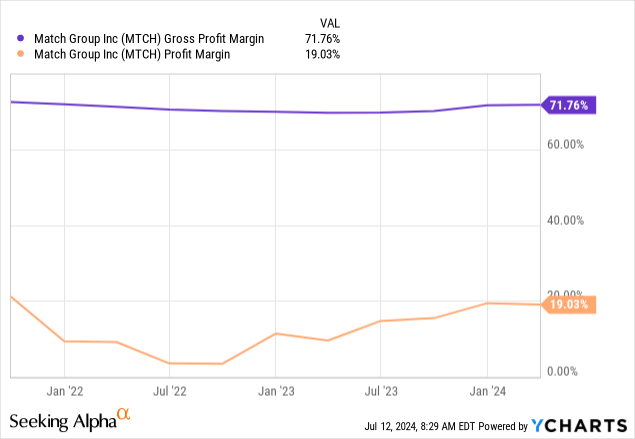

Margins look pretty good. Gross profit margin is consistently high and profit margin has been increasing steadily for the past two years, indicating that the company has become more efficient or has successfully implemented price increases.

The present: assessment and current developments

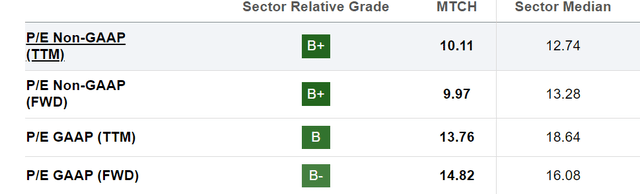

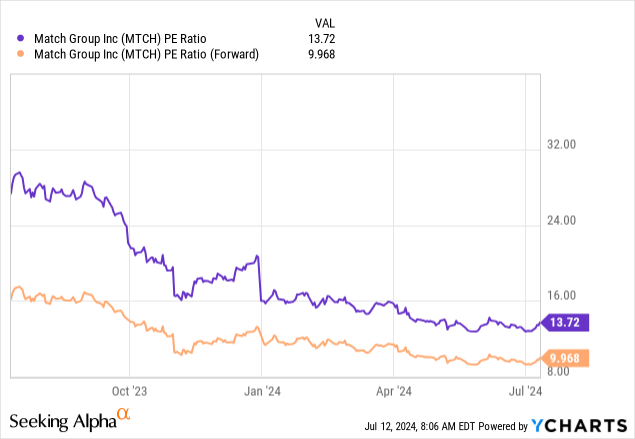

The company is currently valued at $11.4 billion. Its market cap is $8.4 billion, which means that net debt is around $3 billion. The following chart, especially the forward price-to-earnings ratio, shows a negative trend for several quarters.

According to evaluation tab On the Seeking Alpha page, there is no significant difference between GAAP and non-GAAP earnings. I am glad to see this because for some companies the differences are huge.

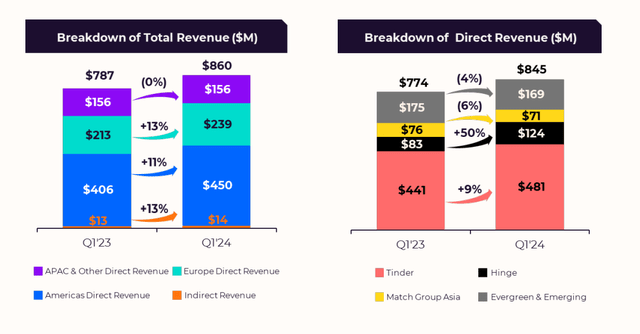

Geographic and applications

Although the company operates in many countries around the world, its sales are mainly in the Americas and Europe. In terms of apps, it is mainly made up of the Tinder and Evergreen brands, but Hinge continues to see strong growth, with 50% year-on-year.

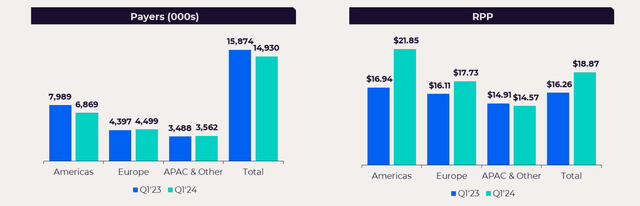

Year-over-year, the number of paying customers decreased by 6% to 14.9 million, a fairly significant drop. The following chart from the first quarter results shows that this decline occurred mainly in the US market. At the same time, this is also where revenue per user (RPP) increased the most. In other words, it seems that prices have been increased, leading to many churns of former paying customers. In the coming quarters, the company should show that it is able to return to the path of growth.

The Future: Perspectives

The market is currently valuing the company relatively cheaply, likely due to economic concerns that could weaken non-core products like dating apps and the decline in paying customers. But this also means potential opportunities. If Tinder’s user base improves and Hinge continues to perform well, the market could once again value the stock higher, which could then lead to excellent returns over a short period of time. If the market were to value the stock at a price-to-earnings ratio of 15, that would mean a 50% gain for shareholders, and we know how quickly that can happen in the stock market.

At Tinder, we have a highly profitable business and a focused strategy to improve on trends. At Hinge, we have the fastest-growing major brand in the category, which we believe will have an increasing impact on the company’s overall results. Match Group expects to generate approximately $1.1 billion in free cash flow (“FCF”) in 2024. We actively return a large portion of our profits to shareholders and expect to continue to do so in the future.

But I think that low valuation is justified at this point. The company is only growing its EPS by about 6% this year, and even that is only partly due to share buybacks. Why should a company with such weak growth be valued at a price-to-earnings ratio of 15 or more? There is also no dividend being paid. The company needs to prove that the number of paying customers will stop declining and that it will grow again. Price increasesas in the past, cannot be repeated every year; moreover, the economic situation in Europe is bad and a recession could follow in the United States. Dating apps are not essential and as inflation and/or weak economic growth put pressure on consumers, the stock market simply does not like slow-growing non-essential products.

Risks

The dating app market is very competitive overall, which makes it difficult for companies to build a solid business model. The irony of dating apps is that if they succeed in getting people to start relationships, they will then disappear as paying customers. This is different from the business model of Netflix or Spotify, where people are willing to keep their subscription for many years. The need for music is still there and remains, but the need to find a partner is not.

Another obstacle is the demographic situation in many countries, which is not favorable. The United States is still better off than Europe, but the general trend is towards an increasingly aging population. The company also cites a decline in spending, which poses problems, especially for Tinder.

Tinder continues to experience pressure on its MAU and is also facing increasing pressure on its a la carte (“ALC”) revenue, in part due to lower consumer discretionary spending. Tinder is stepping up efforts to address these headwinds with ALC product adjustments and the introduction of new ALC features in the coming quarters.

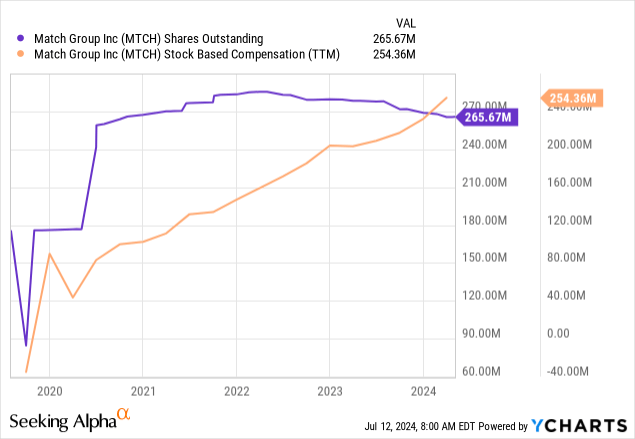

Share Dilution, Insider Trading and SBC

These three items are standard checks I do in every article, as excessive stock dilution and stock-based compensation can disadvantage shareholders. Additionally, insider transactions sometimes contain valuable information about management confidence. SBCs are huge relative to net income ($654 million in the most recent quarter). 12 months) and continue to rise, while the bottom line remains rather stagnant. There are some buybacks – the number of shares outstanding has decreased from $285 million in December 2021 to $265 million today; this represents a reduction of 7%, which improves earnings per share by about 2.7% per year.

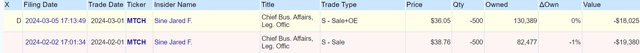

These are internal transactions that have been made in the last six months. There’s not much going on here, which is a good sign.

Conclusion

The stock is an interesting turnaround candidate. After all, it is a company with a globally recognized brand and good margins. However, the situation is unclear: the stock is still trending downward. If the next quarterly figures, published at the end of July 2024, are surprisingly good, the stock could suddenly jump higher. But, of course, this is not guaranteed. If the figures are surprisingly bad, a further sell-off is possible. This is too risky for my taste. That is why I prefer to wait on the sidelines and monitor the next quarterly results. In my opinion, now is not the time to invest in non-core, low-growth stocks.

|

Investor Checklist |

Check |

Description |

|

Rising revenues? |

Yes |

Increasing over longer periods |

|

Improve margins? |

Yes (net profit margin over the last two years) |

Possible competitive advantage |

|

Is the PEG ratio less than one? |

No (10/6 = PEG ratio of 1.6; PE of 10 / EPS growth of around 6% this year) |

A PEG ratio below 1 may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Essential for survival and growth, especially of unprofitable businesses |

|

Rewarding shareholders? |

Yes, buyouts |

Return of capital to shareholders |

|

The negative points of the shareholders? |

SBC quite high |

Actions that disadvantage shareholders |

|

Are stocks in an uptrend? |

No |

Is it trading above its 200-day moving average? |