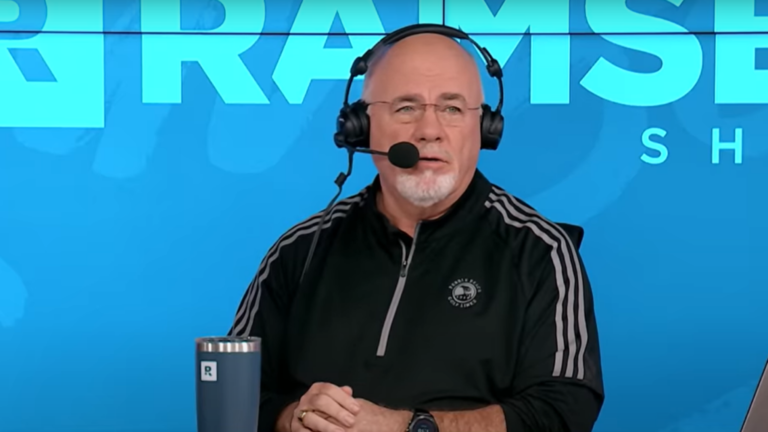

In a lively segment on The Ramsey Show, 21-year-old caller Matt got into a heated debate about the merits of index funds versus mutual funds. Matt, who has been investing since he was 15, called in to ask why the show’s hosts, known for their financial advice, prefer mutual funds to index funds.

Do not miss :

“I’m not a regular watcher of the Ramsey Show, but I see clips online where you talk about mutual funds and investing in mutual funds. I was wondering why you recommend mutual funds over index funds?” Matt asked.

Matt, who works full-time in marketing and earns between $80,000 and $90,000 a year, revealed that he invests between 25 and 30 percent of his gross household income. This impressive savings rate prompted personal finance expert and show co-host George Kamel to applaud Matt’s efforts. “Oh my gosh. OK, so you’re going to be a multi-millionaire no matter what conversation happens next. Can we just agree on that?” Kamel exclaimed.

Kamel then explained the differences between index funds and mutual funds for the show’s listeners. “Index funds are essentially passively managed mutual funds. They track an index, a defined list of companies. Mutual funds are actively managed by an investment manager who selects the funds based on extensive research, with the goal of beating the market.”

Tendency: Mark Cuban Believes ‘Next Wave of Revenue Generation Is Real Estate and Entertainment’ — This new real estate fund allows you to get started with just $100.

Matt pointed out that mutual funds have built-in fees, a drawback Kamel acknowledged. “You have to pay an investment manager, so they have fees,” Kamel explained. “The benefits of index funds include diversification, low expense ratios and predictability. However, your index funds won’t beat the market because they represent the market.” He added that the goal of mutual funds is to outperform the market, although that’s not always a guarantee.

Matt challenged this claim, saying that 80% of mutual funds fail to beat the market over long periods of time. Kamel countered with recent data: “Morningstar reported that nearly 57% of actively managed U.S. equity funds beat the index fund average over the 12 months through June 2023. That’s six out of 10 mutual funds beating the index.”

Despite the back and forth, Kamel stressed that both investment strategies have their place. He noted that Dave Ramsey He himself invests in index funds outside of retirement accounts because of their low turnover and fees, but prefers mutual funds for retirement accounts for potentially higher returns.

See also: Many are surprised to be entitled to a tax reduction on their housing, in just seconds you can see if you can save in 3 minutes or less.

Ultimately, Kamel reassured Matt that his disciplined investing habits would set him up for financial success, regardless of whether he chose index funds or mutual funds. “Matt, here’s the thing: We can talk all day, but you can become a multimillionaire just from your index funds. The key is your savings rate. That’s what keeps people from having money… Invest, for God’s sake. Be like Matt: At 21, you invest $18,000 a year. You’ll have money in retirement no matter where you put it.”

This discussion highlights a key truth in personal finance: regular investing and a high savings rate are both important factors. While the debate between index funds and mutual funds continues, the key is to start investing early and stick to your financial goals.

For personalized advice tailored to your specific situation, consult a Financial Advisor can be a valuable aid in ensuring that your investments are aligned with your long-term goals.

Read more :

“ACTIVE INVESTORS’ SECRET WEAPON” Boost your stock market game with the #1 trading tool for “news and everything else”: Benzinga Pro – Click here to start your 14-day trial now!

Get the latest stock analysis from Benzinga?

This item 21-Year-Old Listener To The Ramsey Show Says Index Funds Are Better Than Mutual Funds, Hosts Tell Him ‘Just Invest’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.