Data shows that “paper” Bitcoin has recently seen a sharp rise, while the cryptocurrency’s spot price has fallen.

Paper Bitcoin rose while spot BTC remained stable

In a new thread On X, analyst Willy Woo discussed the state of the Bitcoin market. BTC has been in a bearish trend recently, with German government sales and Mt. Gox distributions being two of the main sources of FUD among investors.

Woo pointed out that Germany sold around 10,000 BTC, of which 39,800 BTC were still held by the government.

The data for the holdings confiscated by the German government | Source: @woonomic on X

Mt. Gox has yet to distribute that much BTC, with only 2,700 BTC returned to their owners. The bankrupt exchange still has 139,000 BTC to distribute, but the bearish impact of these holdings depends on the willingness of the holders receiving the coins to sell them.

The trend in the Mt. Gox balance over the years | Source: @woonomic on X

It doesn’t seem like these two entities have put that much selling pressure on the market yet. So who is the real culprit behind Bitcoin’s collapse? According to the analyst, it seems to be BTC paper.

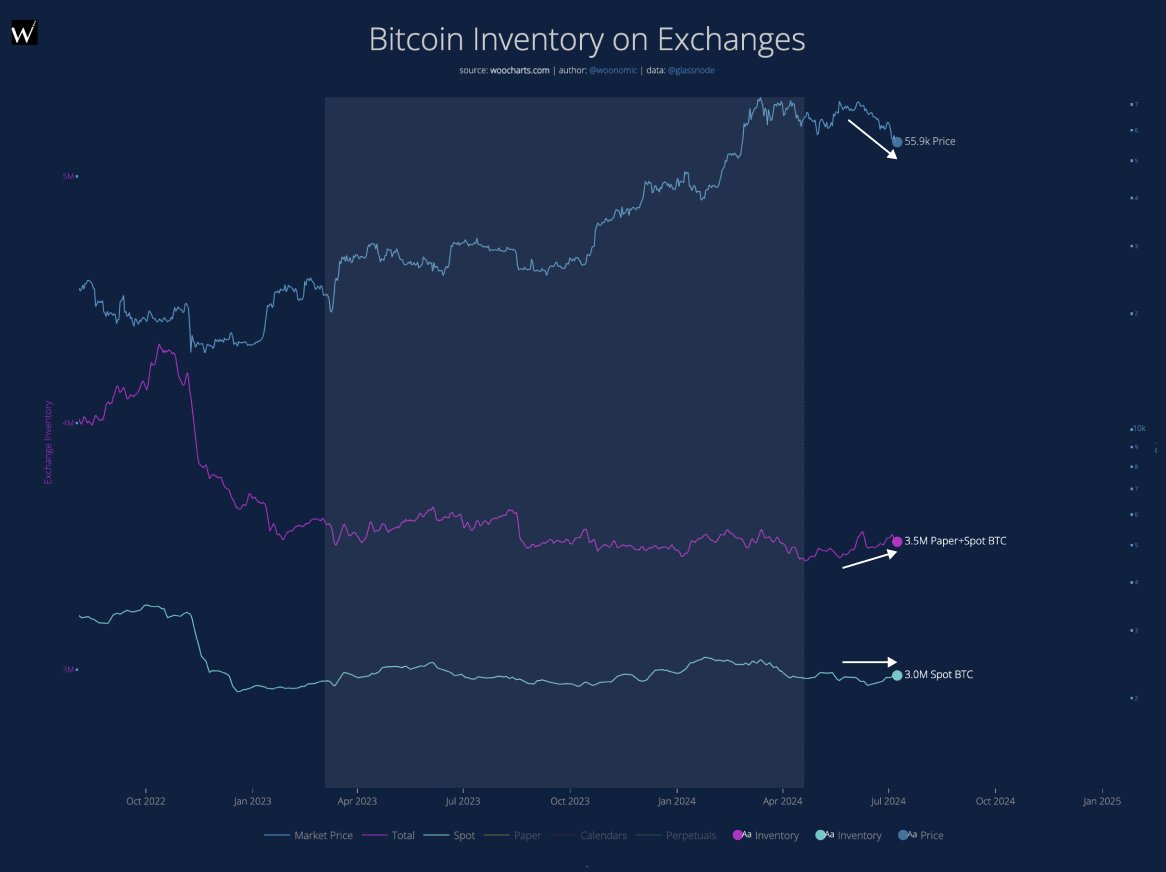

BTC paper refers to the derivative products related to cryptocurrency that does not require the ownership of actual BTC tokens. Below is a chart that shows the trajectory of BTC during this latest drop in the asset.

Looks like the paper plus spot BTC balance has been on the rise on exchanges | Source: @woonomic on X

In the chart, the purple line reflects the combined inventory of paper and spot BTC currently on the various centralized exchanges in the sector. This inventory has been increasing lately.

This increase, however, could be due to spot deposits rather than the creation of paper bitcoins. However, as the blue line shows, spot BTC has been on a flat trajectory while overall inventory has been increasing. This would confirm that paper BTC is indeed the source of this increase.

In total, an additional 140,000 paper BTC were printed recently. “Now compare that to the 10,000 BTC sold by Germany, and you can see what caused this drop,” Woo explains. So it’s possible that derivatives could be forced to take a big hit if the cryptocurrency were to rally.

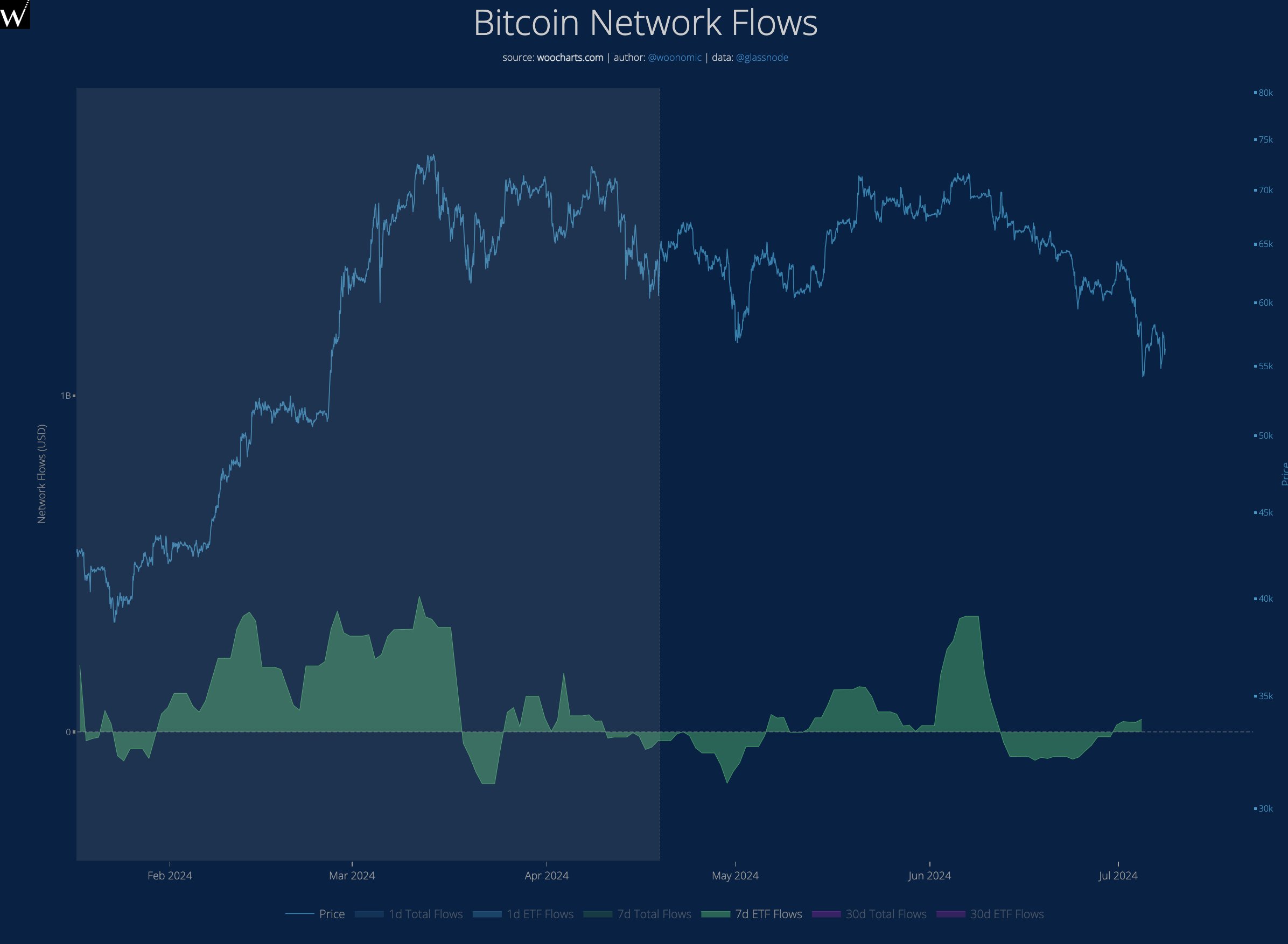

While bearish winds are looming regarding the remaining Mt. Gox and German government sales, a bullish development could also be forming for the coin. As the analyst explained, cash exchange traded funds (ETFs) began to show early signs of accumulation.

The trend in the 7-day netflows of the BTC spot ETFs | Source: @woonomic on X

BTC Price

The past month has been a tough time for Bitcoin holders as the asset’s price has declined by more than 17% and dropped to $57,200.

The price of the coin has been riding on bearish momentum recently | Source: BTCUSD on TradingView

Featured image by Dall-E, woocharts.com, chart by TradingView.com