Richard Drury

Despite economic uncertainty, markets rebounded in the first half of 2024, driven by expected Fed rate cuts and rising AI stocks. The second half of the year should be largely characterized by potential Fed rate cuts, bond market stabilization, and liquidity assets are shifting to risk assets and election-related volatility. Maintaining a disciplined long-term approach will be key to navigating the next six months.

Despite lingering economic uncertainty, the market rallied in the first half of the year, fueled by anticipated Fed rate cuts and a continued surge in AI-related stocks.

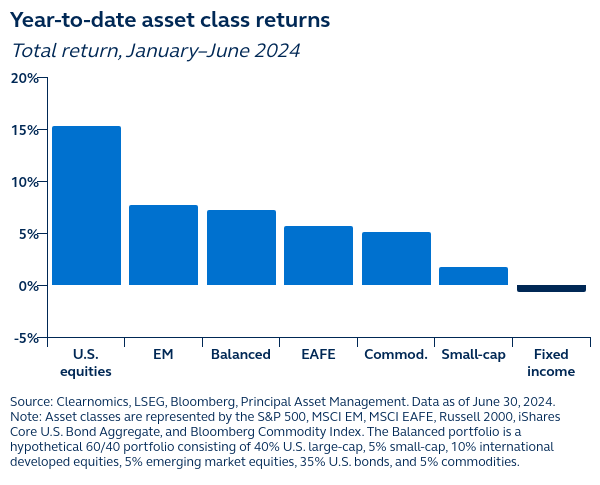

The S&P 500 index gained 15.3%, while the Nasdaq gained 18.6% over the six-month period. The yield on the 10-year Treasury note fell from its April peak of 4.7% to 4.4%, leaving the bond market relatively flat.

International stocks also performed well, with developed markets up 5.7% and emerging markets up 5.7%. Stock markets fell 7.7%. Here are four key factors investors should watch in the second half of 2024.

- Fed moves closer to rate cutas the US economy slows. We expect declines in September and December, but this will require further evidence of a slowdown.

- More stable rates support bondsand pushed up prices, which has allowed the bond market to remain almost flat since the beginning of the year, which is a significant improvement compared to last year.

- Many investors remain in cashattracted by high yields and representing a potential tailwind for risk assets.

- US presidential election heats upleading to increased volatility. History shows that markets can thrive under both parties, which underscores the importance of a long-term perspective.

While these events introduce new risks, the first half of the year shows how overreaction to headlines can lead to poor investment decisions. Staying invested, diversified and disciplined is key to navigating uncertainties and seizing opportunities throughout 2024 and beyond.

Editor’s Note: The summary bullet points in this article were selected by Seeking Alpha editors.