Data shows that the ratio of Bitcoin futures trading volume to spot trading volume has declined by 63% since the peak of the last bull market. Here’s what that means.

Bitcoin Futures Market Sees Lower Volume Share This Rally

As CryptoQuant founder and CEO Ki Young Ju explains in a new job on X, the BTC market appears to be less futures-driven than it was during the previous bull cycle.

The metric we’re interested in here is the “futures to spot trading volume ratio,” which, as the name suggests, tracks the ratio of Bitcoin futures to spot trading volumes.

THE trading volume naturally refers to a measure of the total amount of cryptocurrency involved in transactions on the various exchanges in the sector.

When the ratio value is high, the futures market records a higher trading volume than the spot market. Similarly, low values imply the dominance of spot trading in the sector.

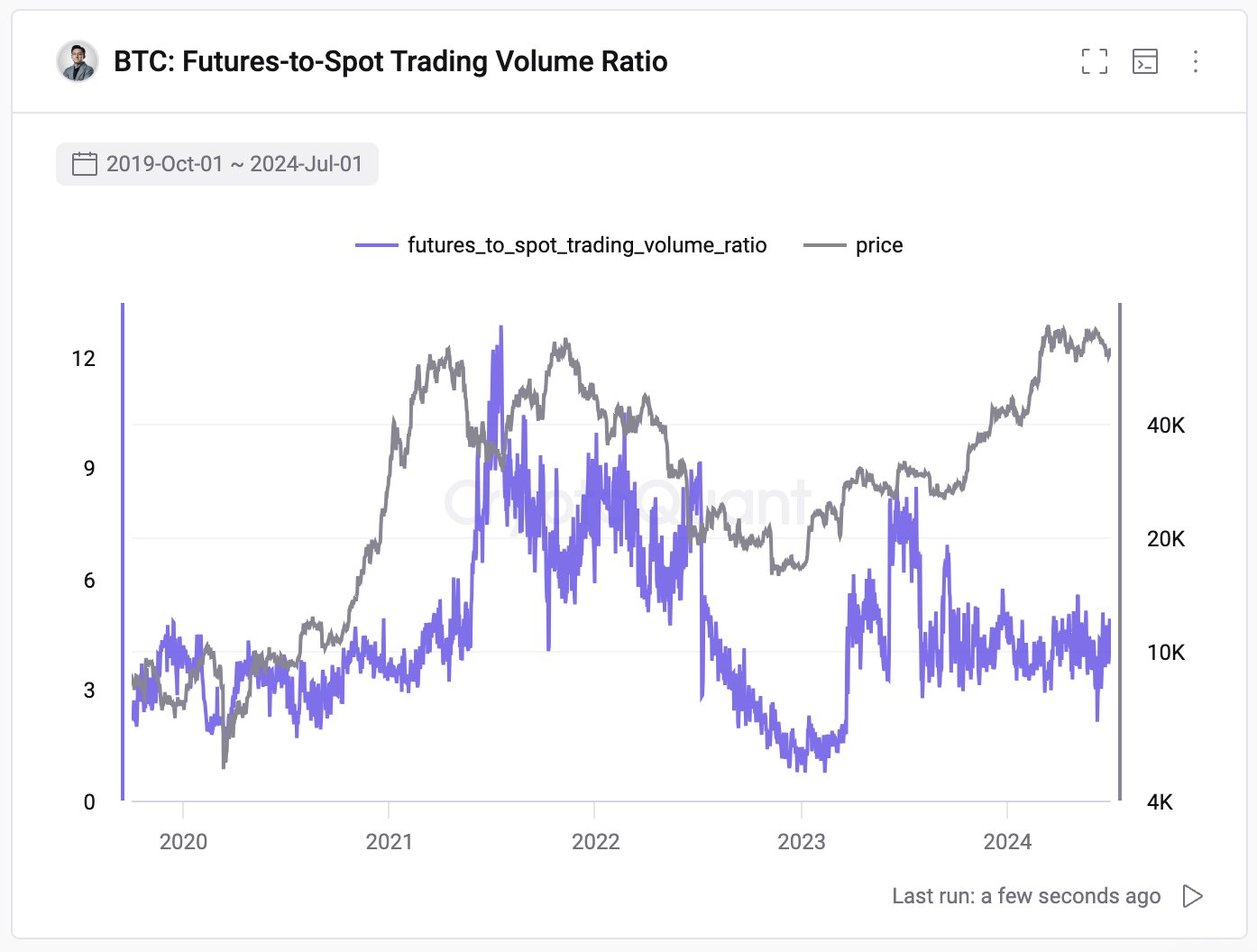

Now here is a chart that shows the trend of the Bitcoin futures to spot trading volume ratio over the past few years:

The value of the metric appears to have been moving sideways in the last few months | Source: @ki_young_ju on X

The chart above shows that the ratio of futures trading volume to spot Bitcoin market has reached quite high levels over the 2021 Bull RunSpecifically, the indicator had crossed the 12 mark at its peak, implying that futures volume had exceeded spot trading by more than twelve times.

After this peak, the metric cooled down during the second half of the 2021 bull run, but it remained at elevated levels. These elevated levels then continued during the first half of 2022.

As the bear market However, the lows had been approached, the indicator had plunged, as interest in speculative activity around the cryptocurrency had faded. With the recovery in 2023, the indicator saw some recovery and reached the same levels as in the first half of 2022 in June.

Since then, however, the ratio has fallen back to relatively low levels and has continued to consolidate around them so far. Compared to the peak in 2021, the value of the indicator is down by around 63%.

Futures trading volume remains the dominant force in the market, but it is much lower than during the 2021 bull run, implying that speculative interest has been relatively low during the run-up. The CryptoQuant founder believes that this shift towards higher spot trading volume is good for the market.

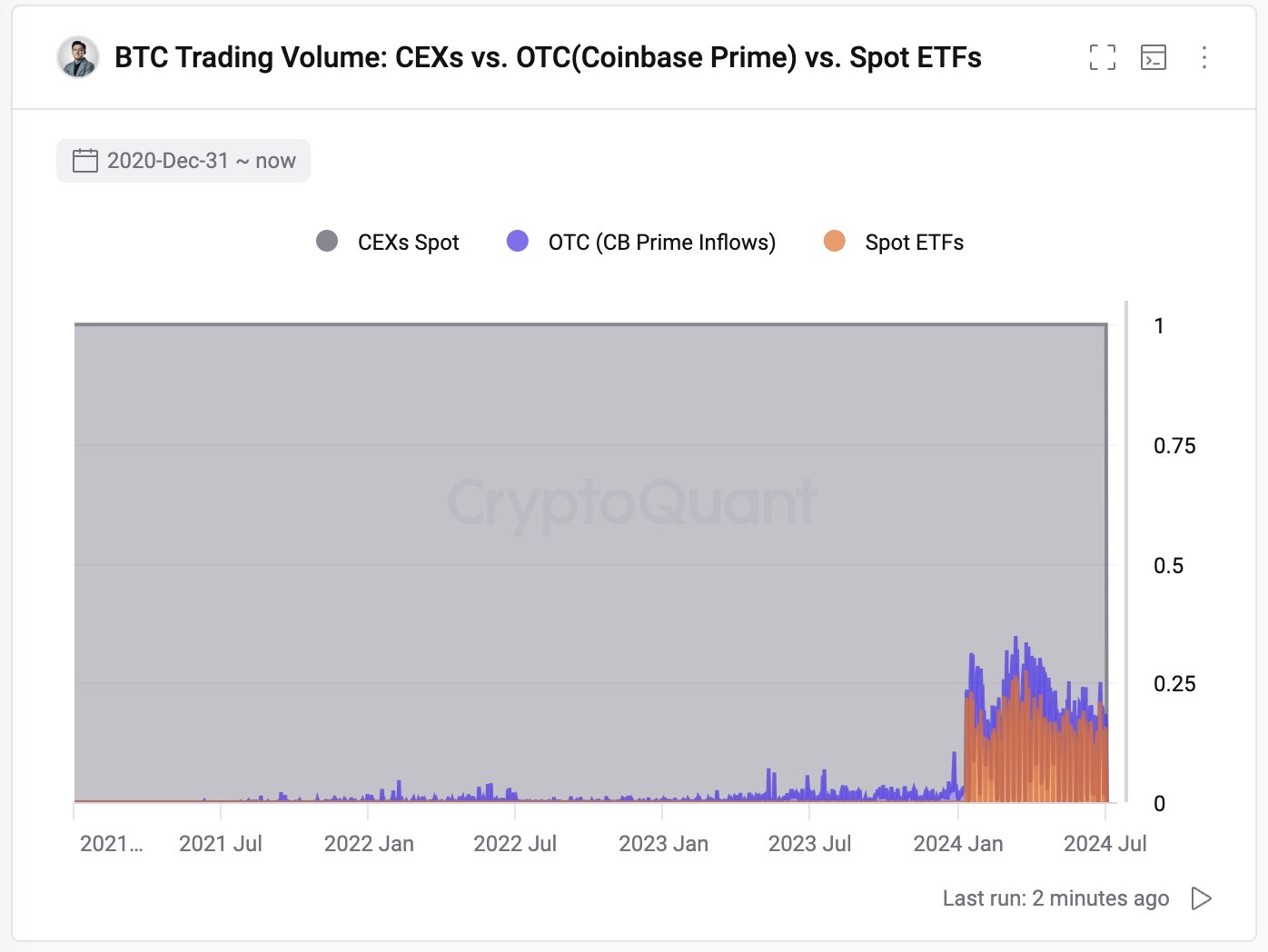

This latest cycle, however, has seen a novelty: the emergence of a new way to trade bitcoins: spot exchange-traded funds (ETFs). So how does the volume of these financial instruments compare to the spot market?

As Ju pointed out in another X jobThese ETFs currently account for almost a quarter of total spot trading volume.

The ETF volume of BTC stacked against its spot trading volume | Source: @ki_young_ju on X

BTC Price

Bitcoin has suffered a drop of more than 4% in the last 24 hours, bringing its price to $57,300.

Looks like the price of the coin has been going downhill in recent days | Source: BTCUSD on TradingView

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com