a posteriori

Thesis

iShares Russell 2000 Exchange Traded Fund (NYSEARCA:IWM) offers an efficient way to gain exposure to US small caps at a time when they appear poised to outperform large caps.

Presentation of ETFs

IWM is an exchange traded fund that provides exposure to 2,000 small-cap U.S. companies. The ETF is passive and attempts to replicate the results of the Russell 2000 Index. The Russell 2000 is market-cap weighted, like the S&P 500 Index.

Price and performance

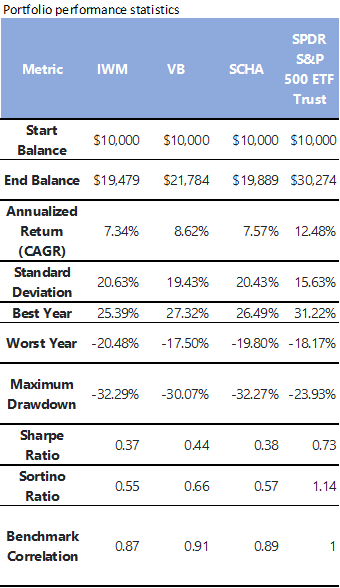

Although passive, IWM’s expense ratio is higher than its peers 0.19% (for example, the Vanguard Small-Cap ETF (VB) has an expense ratio of 0.05% and the Schwab US Small Cap ETF (SCHA) has an expense ratio of 0.04%). These two ETFs track different indices, which, due to licensing, could explain some of the gap in expenses. Although this does not appear to be a Initially this was not a big deal as all three offer passive exposure to the same thing, US small cap stocks, but the reality is that the performance results (since January 1, 2015) have been very different, with VB leading in terms of both absolute (by nearly 1.30% annualized) and risk-adjusted performance. I included the SPDR S&P 500 ETF Trust (TO SPY) for reference (serving as a reference).

January 2015 – May 2024 (Portfolio Viewer)

The ETF’s market performance may diverge from that of the Russell 2000 Index, primarily due to the expense ratio, but has historically been within 20 basis points annualized. As of June 24, 2024, IWM was trading at a 0.02% discount to net asset value. IWM is highly liquid with a 30-day median bid-ask spread of 0.00%, which compares favorably to SCHA’s 0.02%.

Future results

Overall, it is difficult to say which ETF will perform best going forward. However, based on past results, VB appears to offer the best risk-adjusted returns with the lowest drawdown and the best absolute return of the three US small-cap passive ETFs mentioned. That said, I would not immediately dismiss IWM. IWM is very liquid, offering flexibility and optionality. The Russell 2000 Index is the index that many fund managers compare themselves to. It is somewhat of a gold standard for small-cap indices, so the extra expense may be worth it for some.

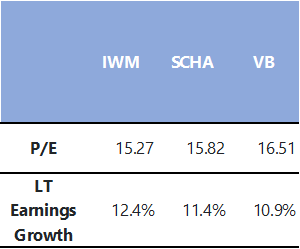

According to Morningstar data, VB has the highest price-to-earnings ratio while posting the lowest long-term earnings growth. IWM actually has the lowest price-to-earnings ratio and the highest long-term earnings growth. This suggests to me that IWM could outperform SCHA and VB going forward.

The Morning Star

Why small caps

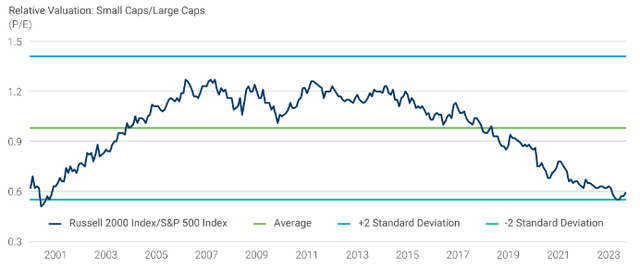

As the Fed increasingly looks to cut interest rates, small caps are a great allocation for several reasons. First, small caps are more exposed to the economy and stand to benefit disproportionately from any economic stimulus compared to their large cap counterparts. Second, small cap stocks trade at a significant discount to their large cap counterparts. The chart below is for the period through September 2023 (the discount is even wider today given the massive gap in performance between small and large caps year-to-date).

Based on data from January 2000 to September 2023. For reference only. (Lazard)

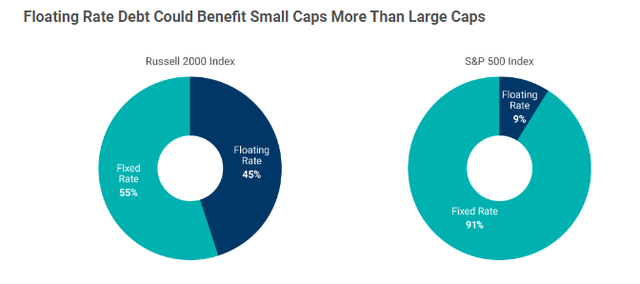

Third, small-cap stocks are much more leveraged than their large-cap counterparts (3.2x net debt/EBITDA vs. 1.6x for the S&P 500, per Lazard) and almost half of their outstanding debt is floating rate debt, so if interest rates fall, small caps’ interest payments fall significantly relative to large caps.

As of September 30, 2023. (Lazard)

Conclusion

There are now more than 3,200 ETFsthat offer a wide range of investment options. It is difficult to determine which ones will succeed and which ones will disappear; however, passive companies based on widely followed and well-regarded indices are likely to persist. Given the drastic undervaluation of small caps relative to large caps and the likelihood of rate cuts in the future, it would be wise to consider adding exposure to small caps eventually. Doing so passively offers excellent options, such as VB, SCHA, and IWM. IWM offers exposure to the most widely followed small cap index, providing a level of comfort and familiarity that VB and SCHA do not. IWM also offers the lowest price-to-earnings ratio and the highest earnings growth, suggesting an opportunity to outperform its peers. At the same time, VB has delivered superior absolute and risk-adjusted returns since 2015. I would carefully consider all options before investing.