BlackJack3D

Presentation of ETFs

First Trust Nasdaq-100 Technology Sector Index Fund (NASDAQ:QTEC) includes a portfolio of technology stocks selected from the Nasdaq 100 Index. The fund implements an equal weighting strategy to construct its portfolio and rebalances its portfolio four times a year. Despite its technology-focused focus, QTEC has underperformed the Nasdaq 100 Index over the past several years as the Mega-Cap 8 (eight mega-cap technology stocks) have contributed the majority of the index’s returns.

QTEC’s equal-weight strategy means it can’t take full advantage of the strong returns from these stocks. Fortunately, the returns from these stocks will likely be much more evenly distributed in the second wave of the AI gold rush. As a result, QTEC has a chance to outperform the Nasdaq 100 Index. For this reason, we’re willing to give the fund a Buy rating.

Fund analysis

Focus on technology stocks

QTEC builds its portfolio by selecting technology stocks from the Nasdaq 100 Index. As we know, the Nasdaq 100 Index consists of the 100 largest stocks (excluding financials) listed on the Nasdaq Stock Exchange. This index is well known for its exposure to the information technology sector, but it also includes other sectors. Some well-known non-technology stocks in the Nasdaq 100 Index include Costco (COST), Honeywell (Honor), Modern (mRNA), Keurig (KDP), PepsiCo (DYNAMISM), T Mobile (TMUS) and Warner Bros. (JMD).

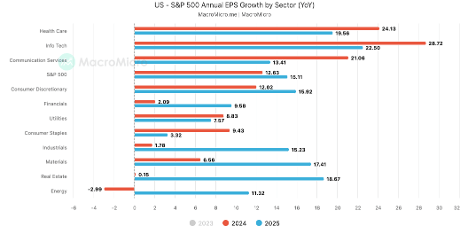

QTEC essentially excludes the non-tech stocks mentioned above. The result is a portfolio of technology stocks. As we know, the technology industry is a growing sector. In fact, the earnings growth rate of this sector is expected to outperform all other sectors in 2024 and 2025 respectively. As shown in the chart below, the consensus estimate of earnings growth for the Information Technology sectors of the S&P 500 Index is expected to be 28.7% and 22.5% in 2024 and 2025 respectively. Therefore, we expect the technology stocks in QTEC’s portfolio to outperform the other sectors as well.

MacroMicro

But QTEC’s performance remains below that of the Nasdaq 100 index.

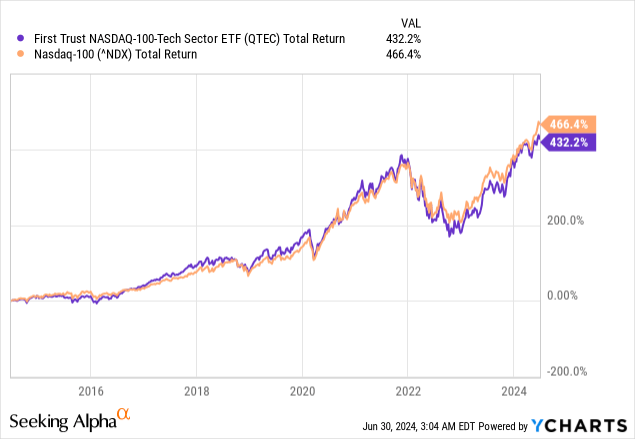

One might expect QTEC’s focus on technology stocks to generate outperformance relative to the Nasdaq 100 Index. Unfortunately, that is not the case. QTEC’s total return over the past 10 years has actually underperformed the Nasdaq 100 Index. Below is a chart that compares QTEC’s total return to the Nasdaq 100 Index over the past 10 years. As the chart shows, QTEC’s total return of 432.2% over the past 10 years lagged the Nasdaq 100 Index’s return of 466.4%.

YCharts

What caused this underperformance?

Why has QTEC underperformed the Nasdaq 100 Index over the past 10 years? If we look at the chart above again, we will notice that QTEC actually outperformed the Nasdaq 100 until about 2022. The outperformance gap peaked in 2020, but this outperformance gradually diminished. Starting in 2022, the trend reversed and the Nasdaq 100 Index started to outperform QTEC. So what caused this reversal after 2022?

We believe the answer is due to QTEC’s equal weighting strategy for constructing its portfolio. This means that the stocks in QTEC’s portfolio are adjusted and rebalanced once a quarter to ensure that all stocks are equally weighted. In contrast, the Nasdaq 100 Index implements a market weighting strategy. QTEC’s equal weighting strategy will outperform a market cap weighting strategy if the growth in the portfolio’s market cap is much more evenly distributed across all stocks. On the other hand, if the growth is limited to just a few stocks, QTEC’s equal weighting strategy will underperform portfolios that implement a market weighting strategy.

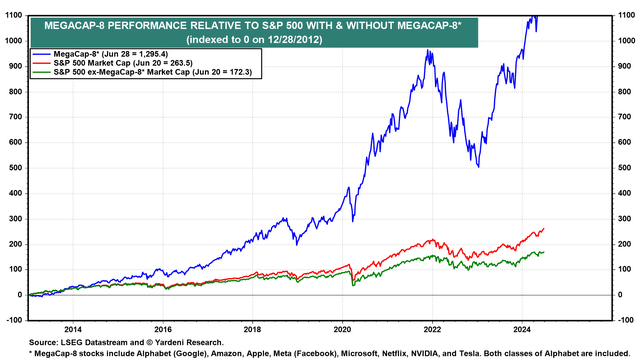

This may have been the case prior to 2020-2022, where QTEC’s portfolio growth is much more evenly distributed across all stocks than it is post-2022. Below is a chart that compares the performance of the Mega-Cap 8 stocks to the S&P 500 Index. These Mega-Cap 8 stocks include Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Facebook (META), Microsoft (MSFT), Netflix (NFLX), Nvidia (NVDA), and Tesla (TSLA). As you can see, these 8 stocks are performing much better than the broader market, especially after 2020. Therefore, funds that implement a market weighting strategy have benefited from the impressive growth of these 8 stocks over the past few years. In contrast, QTEC’s equal weighting strategy means that the fund has not been able to fully benefit from their growth.

Equal weighting strategy could be beneficial again

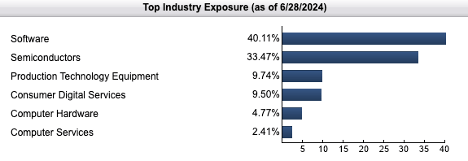

Although QTEC has underperformed the Nasdaq 100 Index in the past, we believe there is a chance for a trend reversal. Below is a chart that shows QTEC’s sub-sector distribution. As the chart shows, the software sub-sector represents approximately 40.1% of the total portfolio, followed by semiconductors at 33.5%.

First trust

As we know, the tech industry is currently riding the wave of artificial intelligence and GPTs. In the first wave of this AI gold rush, a handful of chip vendors like Nvidia were the main beneficiaries. Nvidia has even seen its stock price increase by over 600% since the beginning of 2023. It is unfortunate that QTEC’s equal weighting strategy and frequent rebalancing prevent it from fully benefiting from Nvidia’s stock price increase.

Fortunately, we believe QTEC can benefit from the second wave of the AI gold rush. Unlike the first wave of the AI gold rush, where it was mostly a handful of semiconductor stocks that benefited, we believe that in the upcoming second wave, it will be software companies that benefit the most. This is because many software companies will integrate artificial intelligence into their applications. Since there are a wide range of different applications in the software industry, growth will not be concentrated in just a handful of companies, as was the case in the first wave of the gold rush. It will be much more evenly distributed across the different software companies. Since QTEC has a large exposure (40.1%) to these software companies, it should benefit and perhaps even outperform the Nasdaq 100 Index.

An equal weighting strategy also means higher expenses

One downside to holding QTEC is the transaction costs required to rebalance your portfolio every quarter. In fact, QTEC’s expense ratio of 0.57% is significantly higher than the 0.2% expense ratio of the Invesco QQQ ETF (QQQ) which tracks the Nasdaq 100 Index. A simple, if imprecise, math calculation tells us that a 0.37% difference over 10 years will result in a 3.7% difference in returns. Therefore, QTEC’s higher expense ratio is still worth noting.

Key takeaways for investors

Despite QTEC’s higher expense ratio, we like QTEC’s focus on the fast-growing technology sector. Its equal-weight strategy to construct the portfolio may not be the best in the past, but it has the potential to outperform the Nasdaq 100 Index in the second wave of the AI gold rush. Therefore, we are willing to assign a Buy rating to QTEC.

Additional Disclosure:This does not constitute financial advice and all financial investments involve risks. Investors are advised to seek professional advice before making any investment.