DNY59

The S&P 500 fell more than 5% from its high of 5,264. I think this should have been done quite late. We should reflect on the Fed over the past few months. They teased 3 rate cuts in 2024 last month, and markets pushed higher in response. Then, just a few days ago, Chairman Powell said the cuts seemed less likely. This should not have surprised anyone because inflation is still well above the 2% target and has even recently retrieved.

Explaining the Fed Game

The basic strategy, from the Fed’s perspective, is to hint at certain things to elicit a response while retaining the option to change course. This causes the market to react in a certain way, and the Fed can then do something else to achieve certain monetary policy goals.

Let’s look at a practical example. In March, they announced 3 rate cuts. Most people should have understood that this was probably not going to happen, as inflation was still far from 2%. The Fed also knew, more than likely, that this wouldn’t happen. So what’s the point of saying it? I think the answer is to gauge the reaction and buy time.

The market has reacted quite favorably and that in itself is telling: investors are practically salivating at the prospect of a rate cut. A reduction would therefore be far too inflationary. So, the following month, Powell suggests that this was all very unlikely and assesses the reaction again while buying time.

The secret is that each time, the market will organically arrive at new price levels based on a certain perception of what it thinks the Fed actually means based on what it says. The Fed’s actual work may be strictly negative: it doesn’t need to do much because all markets reach equilibrium without requiring much intervention. You only need to do a little to make it feel like the “right thing” is being done to keep the music going. For example, the rate hike in 2022-23 gave the impression that there was a strict suppression of inflation, which eased fears of runaway inflation. Signaling cuts in 2024 gives the impression that the Fed is ready to be dovish, as in 2024 many people were likely looking at a correction after a rather strong 2023.

The whole dynamic between the Fed and the market is like a mix between a game of chicken and a prisoner’s dilemma, played out over and over. There’s a lot of guessing on both sides, including guessing what the other party is guessing, and the net result can be unpredictable, although it doesn’t usually lead to anything too crazy.

How Things Went Wrong This Time

The situation in the Middle East disrupts the game by introducing great uncertainty into the mix. That is, if people waited for a moment to start removing chips from the table after big wins, now would be the most opportune time.

When we look at this decline, it is accompanied by classic flight-to-safety behavior as gold recovers with little sign of slowing down. Additionally, tensions in the Middle East have driven up the price of oil, increasing costs worldwide and hurting revenue. We could be seeing the start of a commodities supercycle, as people move out of high-performing US tech stocks, fueled primarily by the AI and AGI narrative, into commodities and real physical assets. This is bad for the S&P 500. Gold’s time for outperformance has arrived, which I predicted in This item written months ago.

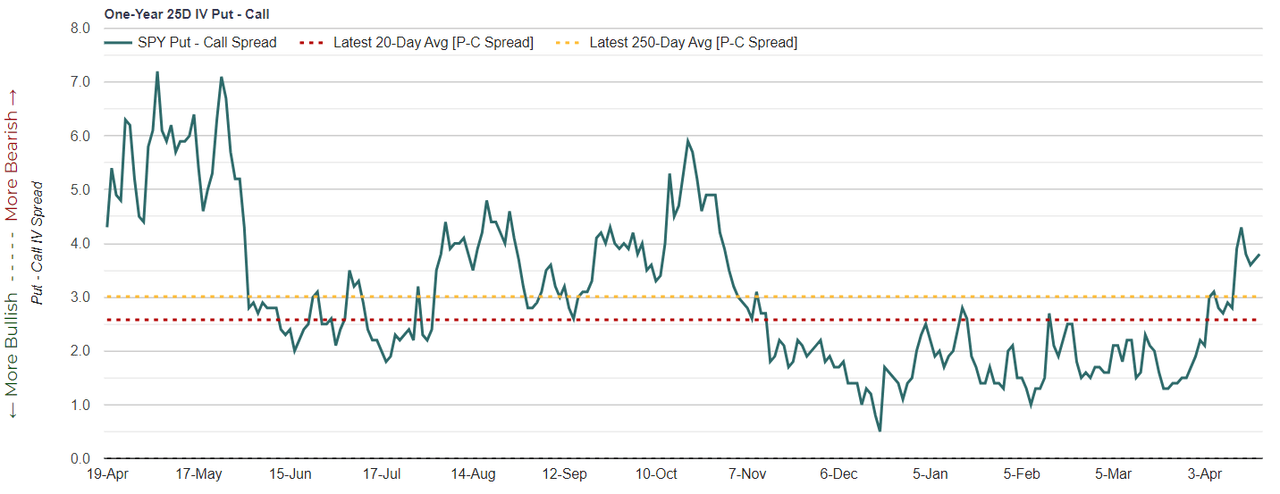

We can also see that the IV bias in SPY options is starting to favor insurance, after hovering below 3.0 for a long time (this is put IV minus call IV for the 25 delta options on SPY). The jump from less than 2.0 to almost 4.0 is quite significant, and the speed at which it happened clearly signals a flight to safety.

SPY Volatility Bias (marketchameleon.com)

The essential

Be careful out there. The seasonal talk of “selling in May” may have come a little early and may even get worse with the flight to safety we are witnessing. The market seems to be saying “sell before May” because the next few months are likely to get crazy.

I don’t think it makes sense to panic sell, especially if you’re sitting on capital gains. Instead, using either a normal put debit spread or a put ratio spread to capture the high IV OTM put while still getting some protection is probably the best way to cover this. Here is the exchange I propose to you:

Go long on the May 31 SPX 4960 put. The average price is $93. Opt for two SPX 4810s on May 31. The average price is $50. The total position is a $7 credit, before fees. If SPX falls, everything from 4960 to 4810 is protected, representing $150 of protection. Below 4810, the position starts to look like a short put option, but you will have received the $7 credit and $150 protection. And if SPX goes up from there, you just keep the $7 credit.

Overall, this trade has good expected value as it capitalizes on the high implied volatility of OTM puts while providing protection against shorter drawdowns. The risk of SPX drops significantly from there and completely wipes out the money received. This breakeven point is $157 below the lower strike price – or SPX 4653. After this point, the hedge would actually be a loss, but one could probably initiate short sales to capitalize on the even higher IV and get a positive delta to bet on. are linked.