Billionaire Barry Diller is considering taking control of Paramount, the parent company of CBS, MTV and Nickelodeon, according to four people familiar with the matter.

Mr. Diller’s digital media conglomerate, IAC, has signed confidentiality agreements with National Amusements, Paramount’s majority shareholder, the people said. Confidentiality agreements are a key step in closing a deal because they allow both sides to exchange confidential information.

Mr. Diller’s interest in Paramount is the latest twist in one of the most complex and dramatic attempts to sell a media company in years. Paramount had been close to reaching a deal in recent months with Skydance, a Hollywood studio, before negotiations abruptly collapsed.

The nondisclosure agreements were signed some time after the potential deal between Paramount and Skydance fell through in June, two of the people said.

It’s unclear where negotiations between IAC and National Amusements stand. Others have also expressed interest in acquiring National Amusements, including media and finance executive Edgar Bronfman Jr. and Steven Paul, the Hollywood executive best known for his work on the “Baby Geniuses” franchise.

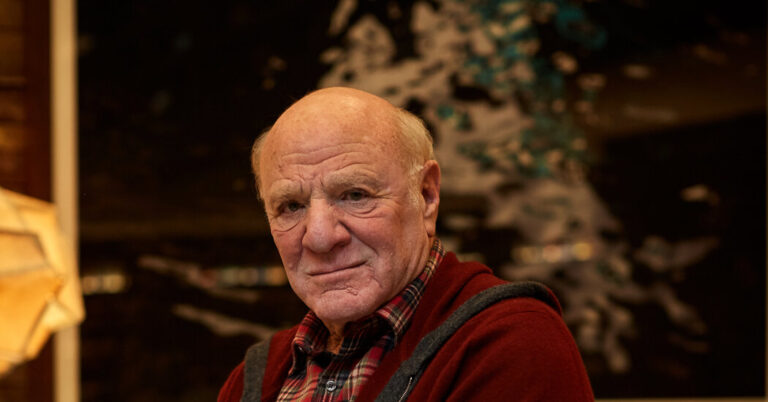

A takeover attempt at Paramount would be a coda of sorts for Mr. Diller, 82, who tried to acquire Paramount Pictures in the early 1990s. He was outbid by Sumner Redstone, the belligerent media mogul whose daughter, Shari, now controls the company.

Mr. Diller was named head of Paramount Pictures in 1974, at age 32. He is credited with rejuvenating the studio, developing a cadre of talented lieutenants, such as future Disney CEO Michael Eisner and studio wunderkind Jeffrey Katzenberg, who became known as the Killer Dillers.

After Mr. Redstone outbid him for the company, Mr. Diller decided to continue building his new media empire, making a series of bold deals to expand IAC.

“They won,” Mr. Diller said in a statement after losing to Mr. Redstone. “We lost. Next.”

National Amusements began exploring potential deals last year. As part of its negotiations with Skydance, Shari Redstone, National Amusements’ largest shareholder, would sell the company to Skydance, while Paramount would merge with Skydance in a separate transaction. That deal was struck scuttled after they failed to agree on non-economic terms following strong opposition from shareholders.

By acquiring National Amusements, a buyer would gain control of Paramount — and its valuable studio library — without having to strike a deal to acquire the company. But it would also mean taking control of an asset with significant liabilities, including about $14 billion in debt and a cable business facing significant headwinds.