omersukrugoksu

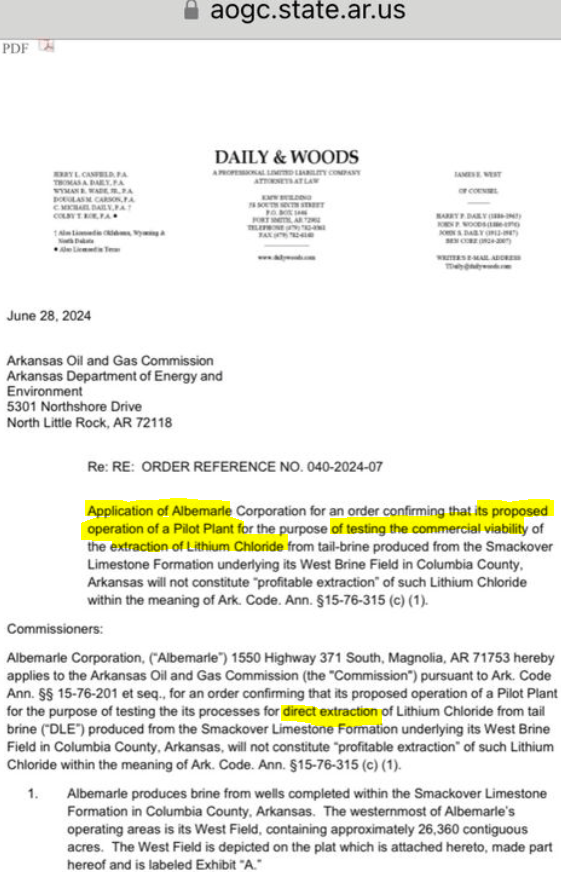

Arkansas is hot right now, hot for lithium and Albemarle (NYSE:ALB) joins the party. Albemarle has applied to the Arkansas Oil and Gas Commission for permission to extract lithium (from its pre-existing bromine operation) via a pilot plant. The intention is to start testing lithium extraction. This is the same manual as the one from Standard Lithium (SLI) used in Arkansas. According to the Arkansas Oil and Gas Commission (AOGC), we can see the application of the Albemarle pilot plant:

Application of lithium by ALB (AOGC) |

Albemarle Lithium Demand Outlook

Now why would ALB do this? I thought lithium was almost dead, right? If you take a look at the depressed share prices of lithium companies, it seems quite kaput. Looking at ALB’s Q1 May 2, 2024 transcript we can see ALB’s lithium demand outlook and it looks positive or perhaps they are taking a long term approach lithium demand perspective:

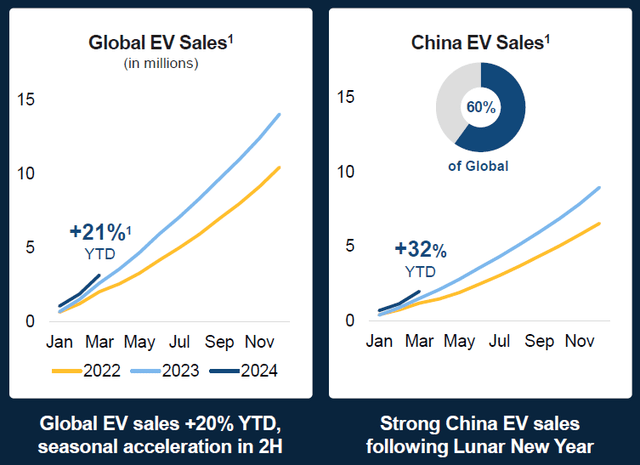

We continue to believe in the transition to electric vehicles and the growth in lithium demand, and the opportunities it creates for Albemarle. Despite a slowdown in demand growth in Europe and the United States, Global electric vehicle sales up 20% year-to-datedriven by strong growth in China, which accounts for more than 60% of the global electric vehicle market.

We continue to anticipate Lithium demand to grow 2.5 times from 2024 to 2030. Additionally, we see battery sizes increasing over time, driven by technological developments and the adoption of electric vehicles. These factors all translate into significantly higher global lithium requirements. To put this into perspective, we expect this industry to requires more than 300,000 tonnes new lithium capacities each year to meet this growth. This means we need more than 100 new lithium projects in resources and conversion by 2030 to meet this demand. ” Source : ALB T1 2024 earnings transcript (emphasis added)

The figures below are very interesting because they give you a good idea of the regional demand for electric vehicles. As you can see, ALB’s estimates paint a picture of rapid growth in electric vehicle sales globally and in China (with China accounting for 60% of global sales).

Growth in electric vehicle sales worldwide and in China (Albemarle)

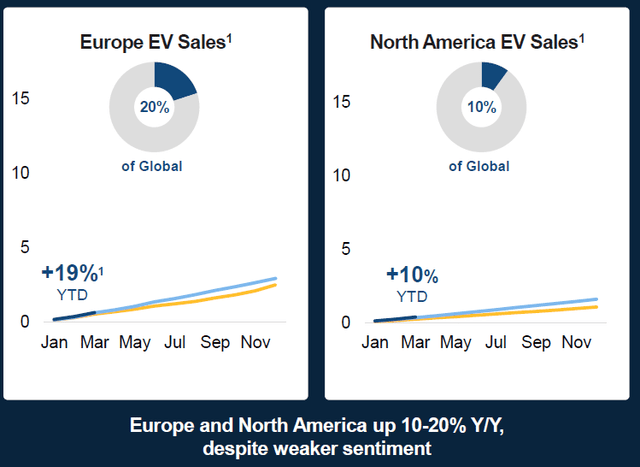

Below we look at electric vehicle sales in Europe and North America. Note that the pace of growth is slower in Europe (19%) than in China, and that Europe represents 20% of the electric vehicle sales market. Finally, we look at North America with its market share of only 10% of global EV sales and low 10% sales growth. We hope that charging stations will continue to be installed in North America to accelerate consumer confidence and sales. Of course, this depends on the health of the economy.

Growth of electric vehicles in Europe and North America (Albemarle)

Lithium inventory

During the Q&A session, an analyst asked about lithium inventory levels. ALB’s response was insightful.

First of all, the other important factor is demand. China is a market and it represents the majority of global demand, over 60% of demand and unlike the US or Europe, which have seen very strong growth, as you may have seen in April, quite significant growth for various automakers, BYD being up 49%.

So growth in China is very strong, thanks to very low inventory levels. And that’s obviously a favorable indicator for prices, given the pressure on producers at these price levels that Kent describes.

And more specifically, inventories are at very low levels, ending in March, relatively speaking. So less than two weeks from a lithium producer perspective, and about a week for downstream cathode companies. That’s in China. It’s a little bit higher for battery producers – or sorry, battery inventories. But again, at very low levels relative to the average that we’ve seen in 2023.

So, coupled with the demand signal that we’re getting from China, we see that as a positive signal for pricing. And obviously, we’ll have to — we’re not sure, but we’ll be watching that carefully. And if that happens, it will benefit our revenues going forward.”

Given the demand outlook, it makes sense that ALB would look to take over its pre-existing operations in Arkansas and mimic SLI in extracting lithium from the background of its operations involving bromine.

A change of investment at Albemarle

Albemarle has slowed its lithium investments a bit and shifted its focus. ALB decided to focus on organic growth rather than mergers and acquisitions. Capital expenditure for 2024 by ALB is estimated be between $1.6 and $1.8 billion (up from $2.1 billion in 2023). ALB is also deferring spending on its lithium refinery project in South Carolina. However, ALB plans to move forward with permitting its lithium mine in North Carolina.

Logically, it is much less expensive in terms of time and capital requirements to extract lithium from a pre-existing operation. So, with all the love felt towards Arkansas via Standard Lithium and Exxon (XOM), it is not surprising that ALB is considering starting lithium production on its pre-existing bromine operation. Therefore, we are seeing the demand for AOGC permits, which is consistent with the focus on organic growth rather than mergers and acquisitions.

Q1 2024 presentation (Albemarle)

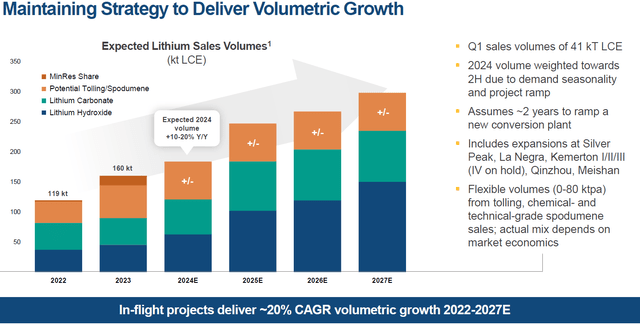

Looking in more detail at the slides, we can see how ALB plans to meet future lithium demand. (click to enlarge)

Lithium supply from ALB (Albemarle)

By the way, it was interesting to see that lithium was mentioned 23 times in the slideshow, while bromine was only mentioned once.

Albemarle Risks and Finance

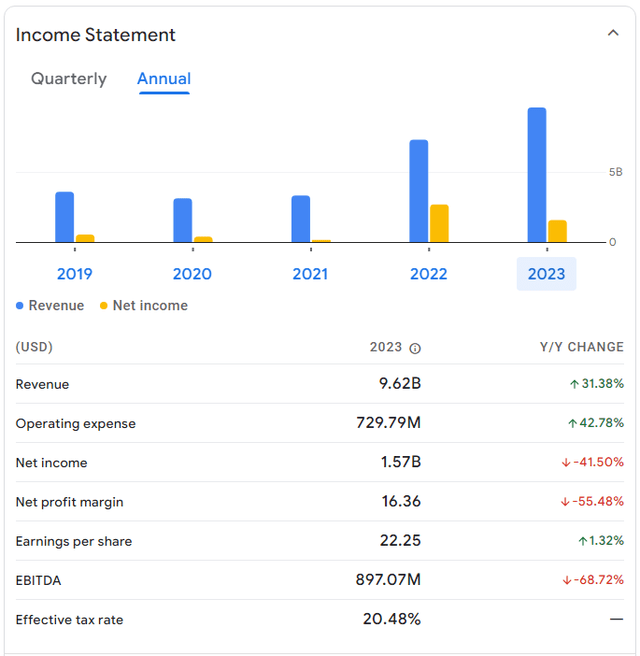

ALB is exercising caution in its lithium expansions. They realize that lithium prices could stay low for a while. Time is something lithium investors need to consider. Will the potential gains on stocks compensate for the time invested in capital? I tend to think so. The biggest risk is frankly the economy. High interest rates and inflation hamper the average person’s life. If the economy continues to deteriorate, car sales could obviously be affected. Looking at ALB’s numbers, we can see an increase in revenues but also costs as lithium prices have fallen. Lithium prices have fallen from the unsustainable $80,000 range to the $12,000-$20,000 range (depending on contract and market). These lower prices have brought ALB’s net profit back to normal levels for the moment. Google Finance:

ALB Annual Income Statement (Google Finance)

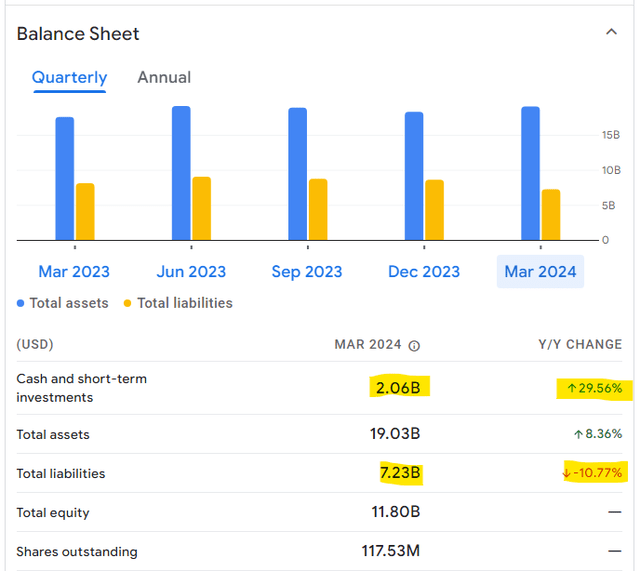

Looking at cash and debt, we can see cash increasing to $2.06 billion while debt decreasing to $7.23 billion. Given the scale of some of these projects, significant debt is not surprising, but ALB has the net profit to pay it off. It is nevertheless positive to see the debt decreasing.

ALB Quarterly Report (Google Finance)

Conclusion

ALB is obviously following in the footsteps of Standard Lithium in Arkansas. I think it will be very successful. I wonder who Exxon and ALB might go to for the DLE (direct lithium extraction) supplier. Could it be the KOCH-Standard Lithium DLE process? Maybe, after all, Standard Lithium-KOCH has been testing it for years in a pilot plant and KOCH is a multi-billion dollar company with deep pockets. It might make sense to partner given the number of years Standard Lithium has been operating its pilot plant in the wild.

Ultimately, within a few years, Albemarle should have a thriving lithium operation in Arkansas. Since this is a pre-existing facility and no DFS has been published, we have no way of knowing the capital costs or the total production that is possible. It is simply too early to tell, but the lithium project should be large enough to have a profound and positive impact on the bottom line.