vm/E+ via Getty Images

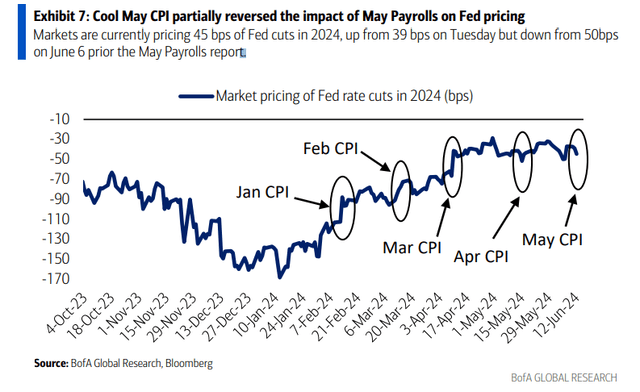

At the start of the year, bond traders expected rate cuts of nearly six quarter points for 2024. That figure rose to nearly 170 basis points at the start of the first quarter, benefiting long-duration assets and to small-cap growth stocks. Thought The economic slowdown would eventually turn into a recession, prompting the U.S. Federal Reserve and other central banks to cut policy rates. But strong economic data prevailed and, one by one, rate cuts were removed from this year’s picture. Unsurprisingly, the same rate-sensitive stocks that drove the market bottom in October 2023 have lost momentum. This includes many titles like “ARK” by Cathie Wood.

I am downgrading the ARK Fintech Innovation ETF (NYSEARCA:ARKF) from buy to hold. Stocks are up slightly this year (total return), significantly underperforming the S&P 500 has returned 15%, and I view its high-growth portfolio as somewhat risky in the current “higher for longer” environment as technicals have become less bullish.

Fewer rate cuts expected through 2024, a headwind for speculative growth stocks

According to issuerARKF is an actively managed ETF that aims for long-term capital growth. It seeks to achieve this investment objective by investing, under normal circumstances, primarily (at least 80% of its assets) in domestic and foreign equity securities of companies that are engaged in the investment theme of the Fund, namely innovation in financial technology (“Fintech”).

ARKF has been losing assets over the past six months. Total assets under management now stand at just $893 million, down from $1.2 billion when I first looked at the ETF. Stock price dynamics has also slowed down, now sporting only a B- ETF rating by Seeking Alpha, compared to an A+ rating a quarter ago and the end of 2023. High annual expense ratio of 0.75% represents a considerable cost, and the fund did not pay a dividend over the past 12 months.

ARKF is considered a risky ETF given both its concentrated allocation and its indicators of high volatility over the past few months. Liquidity is healthyHowever, given an average daily volume of nearly 400,000 shares and a 30-day median bid-ask spread of four basis points as of June 27, 2024, according to ARK Invest.

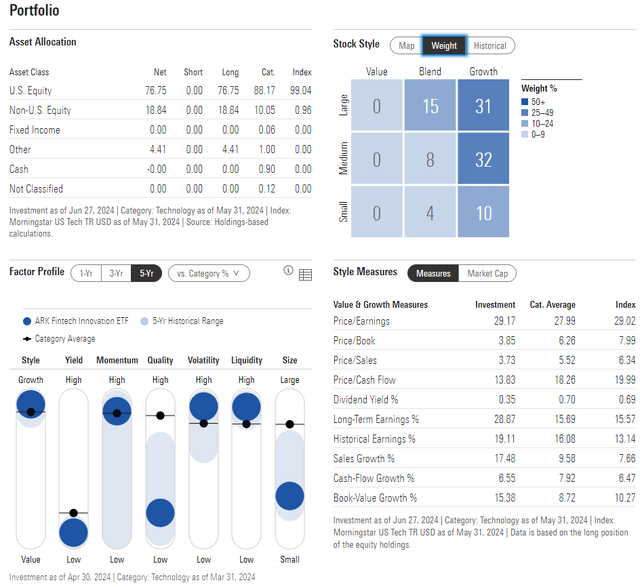

Looking closer at the portfolio, Morningstar’s negative-rated 1-star ETF focuses on the growth side of the style box with mixed exposure across the size range. Thus, the fund is dependent on low interest rates since the growth stocks it holds are not as profitable as some of the free cash flow mainstays in the mega-cap space. Although ARKF’s price-to-earnings ratio has fallen by about 5 rounds, it remains an expensive fund with a solid growth rating.

ARKF: Portfolio and Factor Profiles

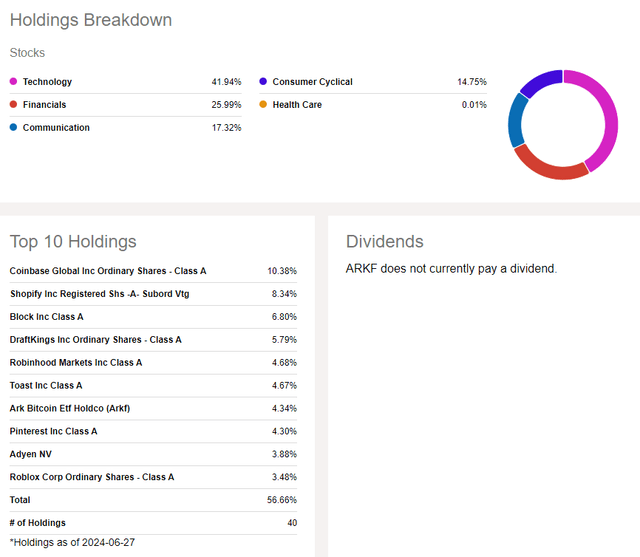

ARKF also focuses on just a handful of sectors. Information technology is the largest weighting at nearly 42%, while financial services represent another significant overweight at 26%. But many of the companies in the portfolio fit into the same “fintech” mold, a niche that continues to struggle amid tight monetary policy.

Still, with bitcoin above $60,000, the fund’s crypto-related holdings are well positioned. Of course, one of the biggest risks is that investors could hold bitcoin directly in a brokerage account through spot bitcoin ETFs, which is different from what I wrote about the fund last December.

ARKF: a concentrated allocation

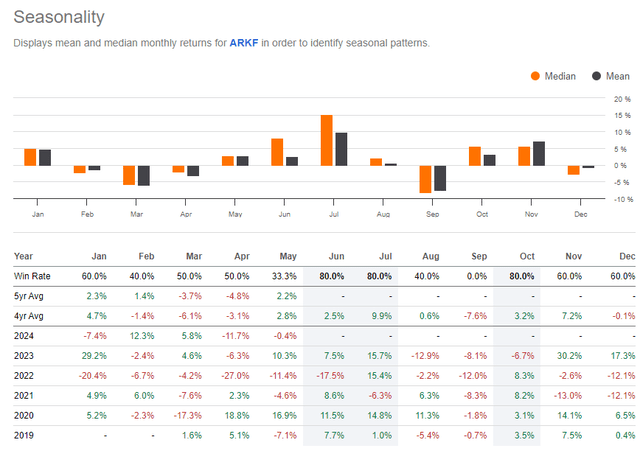

Historically, July has been the best month in ARKF history. Although the sample size is small, only five years, we have seen strong rallies to revive the second half. Volatility, however, has tended to manifest itself in the second half of the third quarter.

ARKF: July Bullish Seasonal History

The technical take

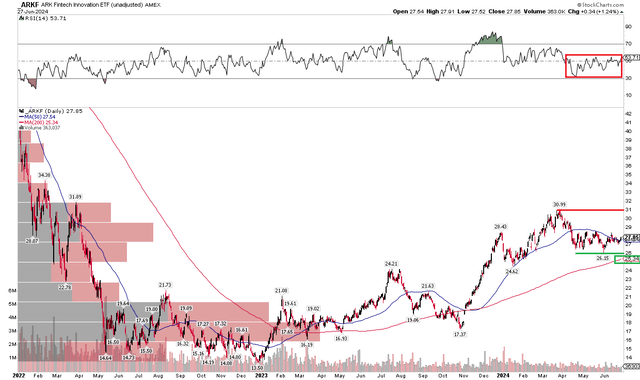

I was hoping that ARKF would continue its strong uptrend started in October of last year as the calendar moved to 2024. There was a stumble early on, but shares managed to reach multi-quarter highs in March. After hitting a high just below $31, shares are only consolidating. This is not a purely bearish move as ARKF’s long-term 200-day moving average remains sloping upward and the ETF continues to print a series of higher lows.

So, I don’t feel so pessimistic about the momentum despite the fund’s significant relative underperformance versus the S&P 500. But take a look at the RSI momentum oscillator at the top of the chart – it remains in a lukewarm range between 30 and 55. Important support comes into play around $26 – the May low and where the 200dma will soon come into play. $31 remains resistance.

Overall, with low relative strength and decent absolute technical trends, ARKF’s chart is mixed.

ARKF: Stocks Consolidate, Key Support Near $26, 200-Day Moving Average Rises

The essential

I have a holding rating on ARKF. The fintech fund has not been able to maintain its strong momentum since October’s low point. Fundamentally, the portfolio could continue to be constrained as interest rates remain high relative to the past five-year average.