Today we are pleased to present an invited contribution written by Christopher A. Hartwell (ZHAW School of Management and Law, Switzerland) and Pierre Siklos (Professor Emeritus at Wilfrid Laurier University and the Balsillie School of International Affairs, Canada).

An article written by both of us, to be published in the International Journal of Central Bankingargues that poorly performing central banks – especially those that fail to meet their inflation targets – not only damage their own credibility, but also the institutional quality of a country. So when one asks how much damage can a poorly performing central bank do? The answer is: quite a lot. Such a conclusion has considerable implications for institutional development, leading to lower overall economic resilience.

Since the policy of central bank autonomy became widespread around the world, monetary authorities have played, some would say, an outsized role in determining the direction of a country’s economy. Given this importance, we hypothesize that the way a central bank behaves can have a considerable influence not only on the performance of the economy but also on the strength of its institutions. For example, a short-term decline in central bank credibility, a flow variable, implies a parallel decline in trust Central banks are placed in a situation where trust is a slower-moving stock market variable. If trust begins to erode in the central bank, a country’s institutions may deteriorate more generally. Weaker institutions translate into less institutional resilience in an economy. We view resilience as a country’s ability to withstand shocks, potentially economic and political in nature.

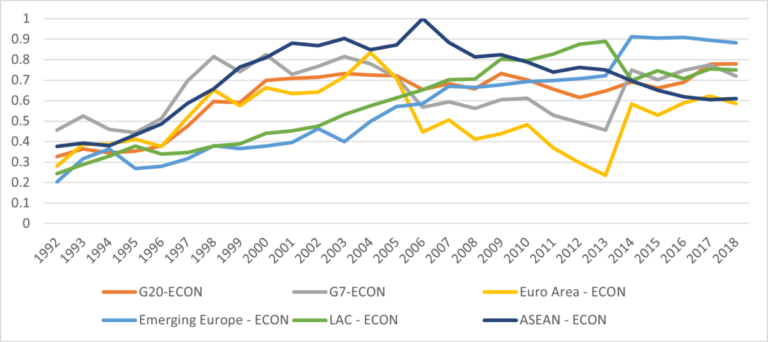

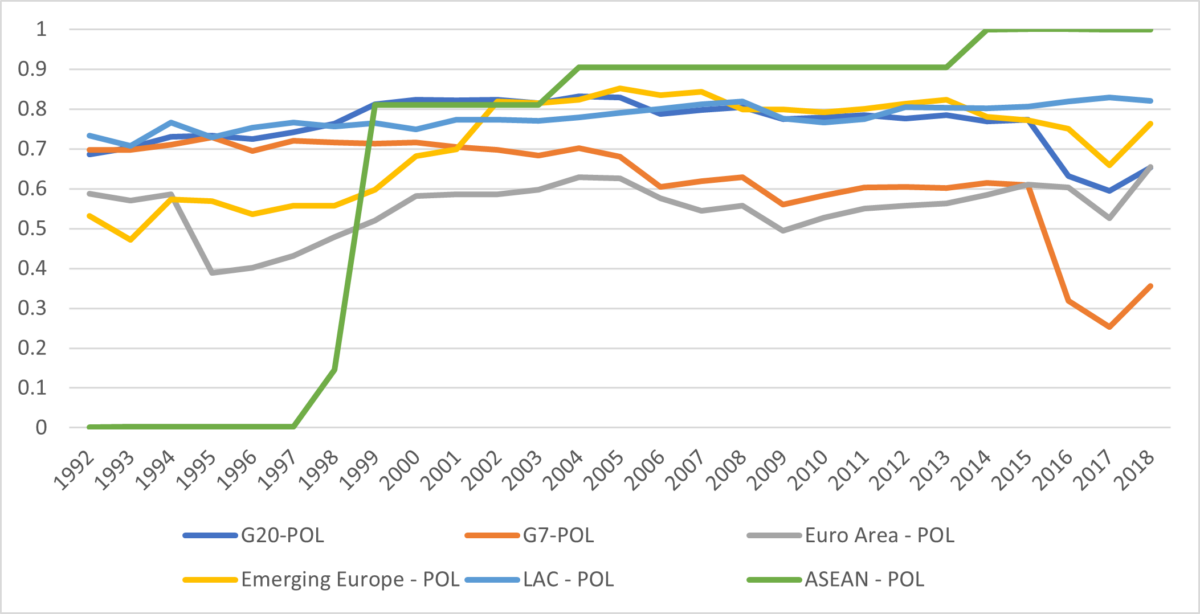

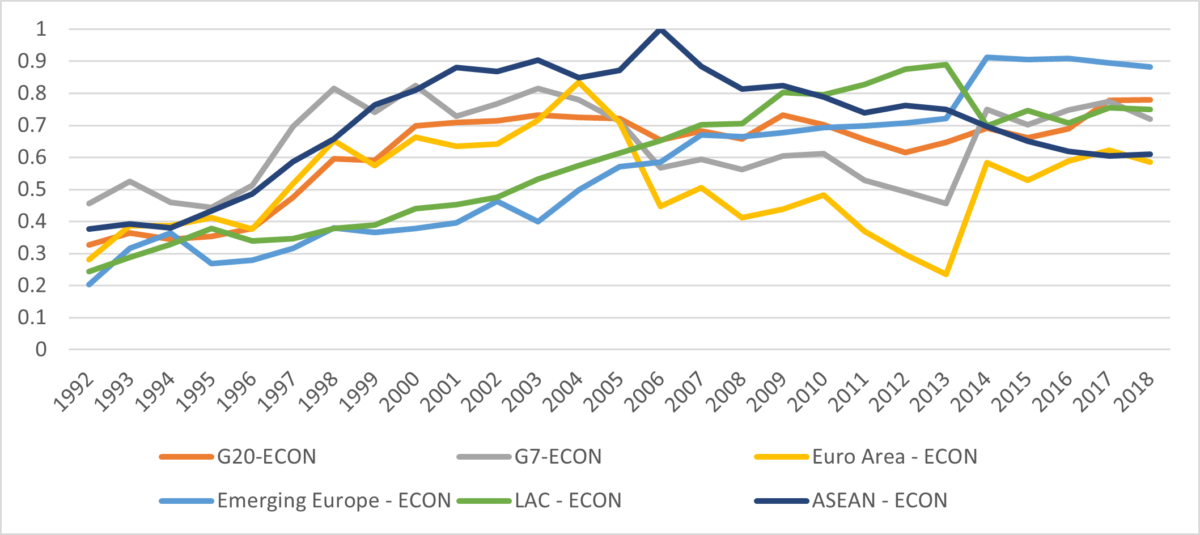

To quantify this relationship, we constructed an index of institutional resilience that encompasses economic (e.g., the extent of property rights, the degree of openness to trade and finance, and exchange rate flexibility) and political factors (e.g., democracy, executive constraints, and government budget size). This index captures attributes that should be positively correlated with resilience, with the exception of government size, which should be negatively correlated (i.e., a large government has little room to maneuver in the face of shocks). The graphs below illustrate our results for economic and political resilience (the index ranges from 0 to 1) for selected groups of countries, although we generated these indices for each of the more than 90 individual countries in our dataset (representing more than 80% of global GDP). Although our data go back to the 1960s, it is only in the 1990s that the broadest range of variables considered is consistently available for countries beyond advanced economies. As shown in the figure below, the 1990s and 2000s saw an increase in central bank resilience globally, although variation over time is considerable and the gaps between the country groups presented show less evidence of convergence at the end of the sample than in the early 1990s. Gaps in policy resilience persist across the sample considered, with a marked decline observed for the G7 countries from 2015 onwards, before the pandemic and recent events. The G7 was among the most politically resilient countries in the early 1990s.

Figure 1: Economic resilience. Higher scores imply greater resilience

Figure 2: Political resilience. Higher scores imply greater resilience

We compare this index to a measure of central bank effectiveness, which is linearly composed of three separate components. First, we compare a central bank’s inflation performance to stated targets—in the case of inflation targeting—or to an implicit target (a five-year moving average of inflation outcomes)—when banks do not have a predefined target. Second, we construct a measure of monetary policy uncertainty, measuring the divergence between inflation and output outcomes and forecasts. Finally, we measure the extent to which a country’s inflation performance is out of step with that of the rest of the world.

Using the generalized method of moments (GMM), model selection techniques, and local projection estimation from a VAR, we find that each percentage decline in central bank credibility corresponds to an average 3.6 percent decline in a country’s institutional resilience since the 1990s. Simply put, the more confidence a central bank loses by failing to meet its inflation targets or deviating from global trends, the more it harms a given country’s overall institutional resilience.

The findings of this study show once again that central bank autonomy can lead to better inflation outcomes, but that a central bank can still pursue poor policies or be ineffective even when independence is controlled. A more efficient central bank, that is, one that focuses primarily on price stability, is better for an economy; More importantly, because central banks play such an important institutional role in an economy, the overall institutional quality of a country may also depend on the performance of a central bank. Although our results rely on imperfect indicators, we have attempted, within the limits of data availability, to establish the sensitivity of our results to changes in definition, changes in sampling periods and data sources. Our main conclusions remain substantially robust regardless of the estimation techniques employed.

This post was written by Christopher Hartwell And Pierre Siklos.