bhofack2

Portillo (NASDAQ:PTLO) shares have fallen 40% year-to-date and are now down 55% in the past year. Investors have fled the stock following a disappointing first-quarter earnings report, concerns about consumer spending and continued selling by private equity firm Berkshire Partners (unaffiliated). with Berkshire Hathaway) since the IPO.

Even though the first quarter numbers weren’t great, at today’s prices I see little fundamental decline in Portillo’s stock (discussed below) and think investors are overlooking some important positives , notably :

- Loyal customer base in the Chicago area, which provides some competitive protection in the event of increased price competition

- Operational improvements through kitchen reconfiguration and storefront cost reduction opportunities through kiosks

- Continued Restaurant Expansion Opportunity in Sun Belt Markets – New Restaurant Footprints Optimized to Improve Return on Capital

- End of Private Equity Surplus Approaches as Berkshire Partners Now Below 20% holding (compared to over 60% at the time of the IPO).

While I was negative at Portillo’s in late 2022 (with stock at 20) and neutral earlier this year at 14Below $10 per share, I am a buyer of the stock (and the delicious Italian beef sandwiches). I see a near-term upside of 60% and 130% (32% annualized) by 2027.

Recent results and short-term outlook

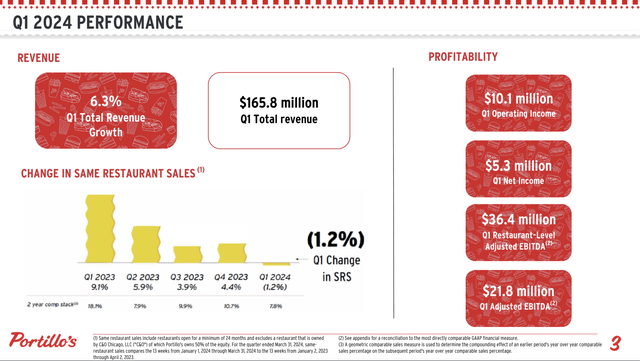

Portillo same-store sales in 1Q24 (Investor presentation)

As noted above, 1Q24 same-restaurant sales were slightly negative, with positive pricing more than offset by same-store transactions that declined 3.2% during the quarter. Although the results were disappointing, it is worth noting that Portillo’s is not alone as several restaurant chains reported lackluster results during their most recent quarter, including Starbucks (SBUX) which recorded traffic of -7% and same-store sales of -3% and Wall Street darling Cava (HOW ARE YOU) which saw traffic decline by -1.2%, contributing to lower-than-expected comparable store revenue growth of 2.3%. Similarly, Darden’s (DRI) The largest restaurant chain, Olive Garden, also reported negative comparable sales (-1.6%) and negative transactions (-2.6%). Nearly all restaurants are under pressure as consumers tighten their belts due to years of inflationary pressures that constrain household budgets and we are likely to see continued weakness in near-term results.

In the near future, Portillo’s will be at a slight disadvantage to its peers in transaction/same-store comparisons, as 55% of Portillo’s locations (and 70% of revenue) are based in Illinois, which has a declining population. Overall, I expect -1% to 0% same-store transaction growth over the next two years (and 0% to 3% same-store revenue growth) until more Sunbelt locations enter the comparison base and bolster transactions.

That said, Portillo has done a reasonable job of managing its profitability in a challenging environment, with restaurant EBITDA margins down just 0.4% year over year and overall EBITDA margins up. Additionally, as described below, there are operational improvement opportunities that should help preserve margins even in a challenging comparable environment.

Opportunities for improvement

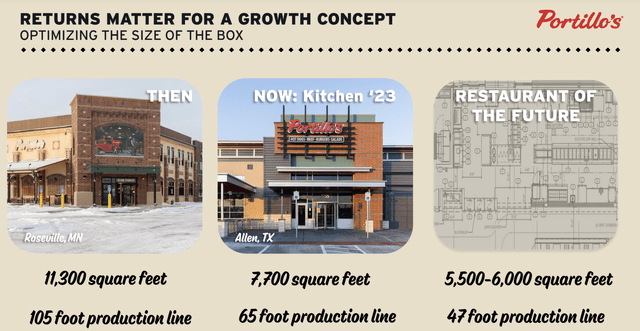

Production line efficiency (Investor Day 2023 Presentation)

Portillo’s has great restaurants, a diverse menu and some operational complexity. Historically, the production line was unnecessarily long (over 30 meters in some facilities), which increased capital and operating costs (lower unit throughput per employee) and slowed service. The company is not only tackling this problem by building new, smaller, more efficient stores (14-20 meter production lines and reducing capital costs by $1 million), but it is also renovating many existing restaurants to improve efficiency and throughput.

Test order kiosks (Seeking Alpha Q24 Results Transcript)

I see the introduction of ordering kiosks as a significant upside for Portillo’s. The benefits are numerous and include: reduced labor costs, improved order accuracy, and faster service time. The company is currently testing kiosks at its California locations and I expect to see them rolled out to all locations within the next two years.

It’s also important to note that Portillo’s has significantly improved the process of opening new restaurants. The company experienced growing pains from 2015 to 2021 because it did not have the infrastructure (dedicated teams for opening new stores) to properly open restaurants and experienced many hiccups along the way (dedicated incredibly long lines, poorly trained employees and in some cases waits of 90 minutes!). Thanks to its scale, Portillo’s was able to invest in new restaurant opening teams, which significantly improved the opening process and improved customer and employee satisfaction.

Assessment

At $9.72 per share, after factoring in debt, Portillo has an enterprise value of just over $1 billion, which is about the price Berkshire took it private for in 2014 (when it only had 40 sites compared to 86 today).

Portillo’s trades at just 10x 2024e EBITDA (and 9x 2025e EBITDA), which is a significant discount to other growing restaurant chains. While I consider the valuations of Cava (100x 2024e EBITDA and 80x 2025e EBITDA) and Kura Sushi (KRUS) at 60x 2024th EBITDA to be euphoric, Shake Shack (SHAKE), which I consider the most comparable peer, is now trading at 21x 2024e EBITDA (and ~17.5x 2025e EBITDA).

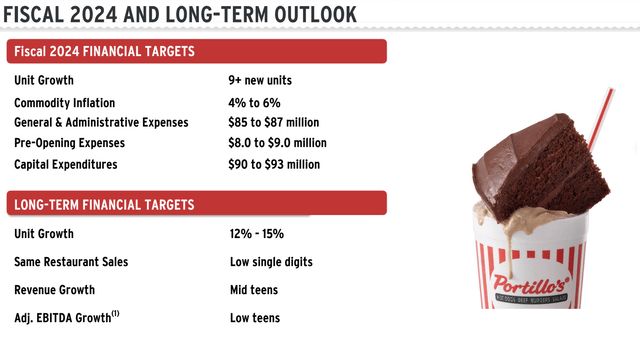

Financial objectives (1Q24 Investor Presentation)

After optimizing restaurant formats and greatly improving the restaurant opening process, Portillo’s has increased its unit growth targets. Additionally, as the company expands further into markets like Phoenix and Dallas, it will benefit from greater scale in advertising and logistics/distribution. While the companies will be burdened by its outsized footprint in Chicago, I view management’s target of low-to-mid-teens EBITDA growth as achievable. As such, I view an EBITDA multiple of 13x as reasonable, suggesting a 2025 fair value of $16 per share, or upside of 60%. Additionally, as Portillo’s demonstrates its growth model, we could see the multiple increase to 15x (still a significant discount for the sector), implying a value of $23 (32% annualized) by 2027.

Risks

- As mentioned above, consumers are tightening their belts when it comes to spending at restaurants and it’s possible that this will lead to further deterioration in same-store sales.

- Portillo’s has net debt to EBITDA of 3x. While I think this debt level is manageable, the balance sheet could become stressed if operating results fall short of expectations.

- Portillo’s is a small-cap stock with a market cap of less than $800 million. Small-cap stocks have significantly underperformed large-cap stocks over the past few years and it is possible that this trend will continue.

Conclusion

Although weak consumer spending has clouded the near-term outlook, I think Portillo’s medium-term picture is pretty bright. With the stock trading at a significant discount to my fair value estimate, I took a position in the stock.