Thanks for your help

Nike stock fell nearly 20% after the company reported strong fourth-quarter fiscal 2024 results but offered weaker-than-expected guidance: The global leader in athletic apparel and footwear said it expects sales for fiscal 2025 be down mid-single digits. Over the long term, however, I believe the selloff creates an attractive opportunity for investors to buy a high-quality franchise at a bargain price. In my view, Nike is poised to remain a winner in the sports industry, driven by unparalleled brand strength, global market presence, and a top-tier athlete support strategy. Based on a valuation anchored by a residual earnings model, I assign a “Buy” rating to Nike shares and set my price target at $91.

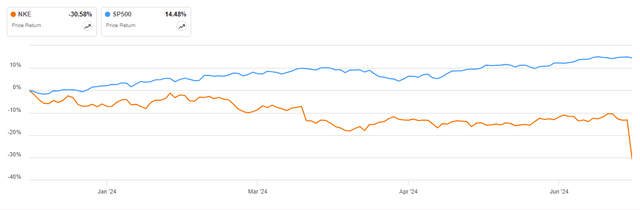

For context: Nike stock has significantly underperformed the broader U.S. stock market this year. year. Since the beginning of the year, NKE shares are down about 31%, compared with a gain of nearly 15% for the S&P 500 (SP500).

Nike’s Q4 FY2024 Results Are Strong; But With Disappointing Guidance

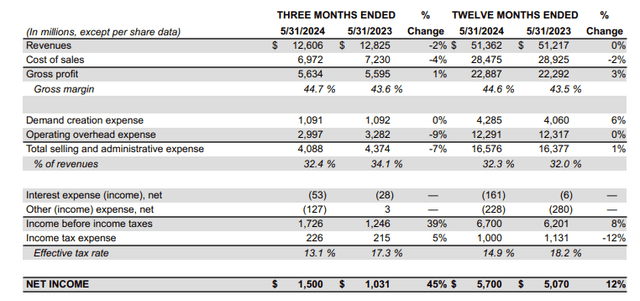

On Thursday, June 27, after the market closed, Nike released its financial results for the latest quarter, beating Wall Street expectations for revenue and profit: In the period from March to the end of May, the global leader in athletic apparel and footwear reported sales totaling about $12.6 billion, down 2% year-over-year from $12.8 billion in the same period a year earlier, but beating analysts’ consensus by about $150 million, according to data collected by Refinitiv. On a channel basis, NIKE Direct revenue declined 8% year-over-year to $5.1 billion. Wholesale revenue was $7.1 billion, up 5% year-over-year. This represents a negative mix shift as NIKE Direct, which typically generates higher margins, saw revenue decline year-over-year, while Wholesale, which typically has lower margins, saw an increase.

In terms of profitability, there was good news for investors, as gross margin increased by around 110 basis points, to 44.7%, while total selling and administrative expenses decreased by 7% year-over-year, to around $4.1 billion. In this context, operating profit amounted to $1.7 billion, up 39% year-on-year compared to $1.2 billion for the same period a year earlier. Net profit was reported at $1.5 billion, up 45% year-on-year.

Looking at Nike’s report for the fourth quarter of fiscal 2024, it’s evident that the numbers were actually quite strong; What spooked investors, however, were management’s comments regarding the outlook for fiscal 2025. In the conference call Along with analysts, Nike Chief Financial Officer Matthew Friend said revenue in the new fiscal year would likely be down single digits. To justify the weak forecast, he pointed to a number of notable headwinds (emphasis mine)

We manage a product cycle transition with complexity amplified by changing channel mix dynamics. A return to this scale takes time. With this in mind, we considered a number of factors and scenarios when revising our fiscal 2025 outlook. Most importantly, this includes the timing and pace of managing market supply for our traditional footwear franchises, lower growth in NIKE Digital, particularly in the first half of the year due to lower traffic on fewer launchesplan for decline of classic shoe franchises given fourth quarter trends, as well as reduced promotional activityincrease macroeconomic uncertaintyparticularly in greater China, with uneven consumption trends continuing in EMEA and other markets around the world, and sell to wholesale partners as we drive product innovation and newness to the market and finalize second half order books.

Based on the weaker revenue outlook, coupled with guided gross margin expansion of 10 to 30 basis points, I estimate that Nike’s fiscal 2025 operating profit will likely be between $5.2 billion and $5.4 billion, suggesting that Nike’s forward P/EBT trades closely in line with the broader S&P 500, at around 22x.

Nike is poised to remain a winner in sportswear

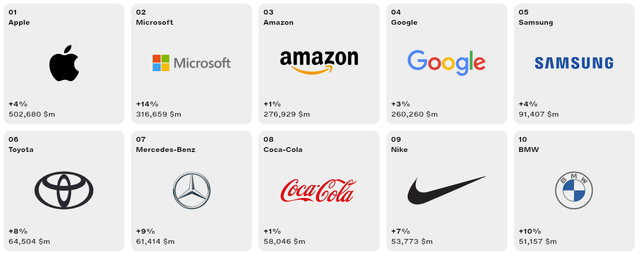

Beyond the short-term growth hurdles, in my opinion, Nike is poised to remain a long-term winner in the sports industry due to the company’s unmatched brand strength (ranked 9th for the world’s most valuable brands, an extensive presence in the global market and a strategy to promote high-level athletes.

Although the product life cycle is currently a concern for Nike, it does not have to be long-term. In fact, Nike is focused on accelerating its pace of innovation and developing new products across its portfolio. This includes the introduction of new performance and lifestyle models such as Pegasus Premium, Vomero 18 and new iterations of Dynamic Air. In this regard, the upcoming Paris Olympics provide a major opportunity for Nike to showcase its innovations and enhance brand distinction through storytelling and commercial activation. When it comes to operational efficiency and cost management, it’s important to note that Nike is doing a good job unlocking savings by reducing fulfillment costs, consolidating suppliers, and optimizing technology spend. This is highlighted by the gross margin expansion of 100 basis points for fiscal 2024 and the planned expansion of 10 to 30 basis points planned for fiscal 2025.

Valuation: probable fair value at $91 per share

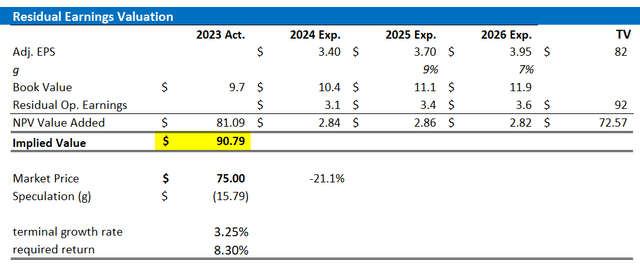

To find a valuation anchor for stocks, I’m a big proponent of the residual earnings model approach. This model is based on the principle that a company’s valuation should be equal to its discounted future profits after taking into account the capital charge. According to CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for the opportunity cost of common stockholders in generating net income. It is the residual or remaining income after accounting for the costs of all of a firm’s capital.

For my Nike stock valuation model, I make the following assumptions:

EPS Forecast: I use the consensus forecast of Bloomberg Terminal analysts until 2026. Beyond 2026, I consider the estimates too speculative to be reliable. However, the analyst consensus over 2 or 3 years is generally accurate.

Capital charge:I use the CAPM model to estimate Nike’s cost of equity, which suggests a rate of 8.3%.

Terminal growth rate:I apply a terminal growth rate of 3.25% after 2026, which I think is reasonable (about 50 to 100 basis points above nominal GDP growth to reflect the strength of the franchise).

Based on these assumptions, I calculate a base price target for Nike of approximately $90.79 per share.

Company financials; EPS estimates from Bloomberg and author; Author’s calculation

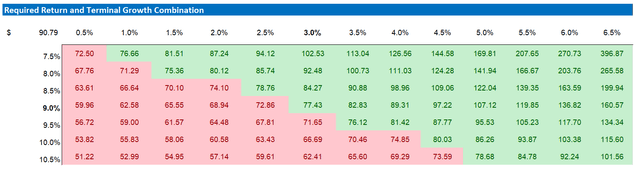

For investors with different assumptions regarding Nike’s cost of equity and ultimate growth rate, I highlight the attached sensitivity chart.

Company financial data; Bloomberg and author’s EPS estimates; author’s calculation

Key takeaways for investors

Nike shares fell nearly 20% after the company reported strong fiscal 2024 fourth-quarter results but provided weaker-than-expected guidance. The global leader in athletic apparel and footwear said it expects fiscal 2025 sales to decline by about 5%. Despite the short-term setback, I think the selloff presents an attractive buying opportunity for investors looking for a high-quality franchise at a discount. In my view, Nike is well-positioned to remain a dominant force in the sports industry thanks to its unparalleled brand strength, vast global market presence, and exceptional athlete support strategy. Any time Mr. Market offers you a top 10 global brand for a 20% discount, you should probably take the offer. This time should be no different. Based on a valuation anchored on a residual earnings model, I assign a “Buy” rating to Nike shares and set my price target at $91.