On-chain data shows that the supply of long-term bitcoin holders has continued to decline recently. Here’s what that could mean for the asset.

Long-Term 30-Day Bitcoin Holder Supply Change Has Been Negative Recently

As CryptoQuant author Axel Adler Jr explains in a job on X, the supply of long-term BTC holders has shown no signs of growth recently. THE “long term holders» (LTH) refers to Bitcoin investors who have held their coins for more than 155 days.

LTHs constitute one of the two main divisions of the BTC market based on holding time, with the other cohorts known as “short-term holders” (STH).

Statistically, the longer an investor holds their cryptocurrencies, the less likely they are to sell them at some point. Thus, LTHs are considered the stubborn part of the sector, while STHs include the fickle investors.

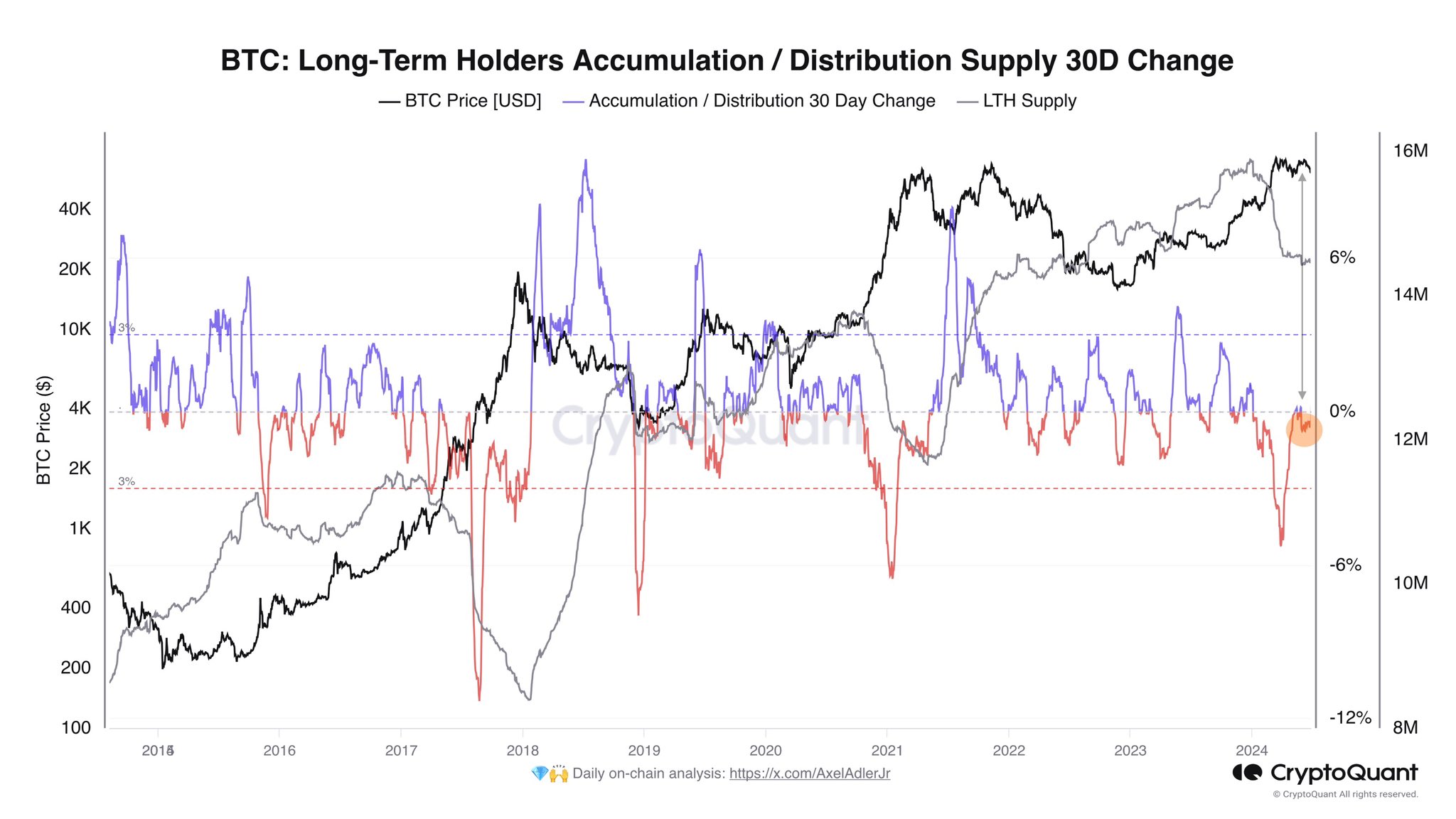

Despite their resilience, Bitcoin LTHs have recently been involved in a sell-off. Below is a chart that shows the trend of the total supply held by these HODLers and its 30-day change over the past decade.

The value of the metric seems to have been negative in recent weeks | Source: @AxelAdlerJr on X

The chart above shows that Bitcoin LTH supply has been declining since cash exchange traded funds (ETFs) received approval from the U.S. Securities and Exchange Commission (SEC) in January.

From the 30-day change chart, it is evident that the metric’s fall was the steepest when the rally to the new all-time high price (ATH) occurred.

These diamond hands hold their coins for long periods of time and tend to accumulate large wins. The timing of the sell-off would indicate that these profits exploded so much during the rally that even these diamond hands gave in to the lure of profit-taking.

Despite the bearish price action the cryptocurrency has seen recently, the indicator has continued to decline, although the decline has been much less steep.

The continued drawdown is all the more interesting as the ETF’s spot approval launch is now over 155 days ago. It would appear that whatever was purchased from HODLers back then is currently being canceled out by new sales from older members of the cohort.

Axel notes that the lack of growth in LTH supply could imply the presence of general pessimism in the market. As the chart shows, this is not a new phenomenon in this cycle.

It appears that Bitcoin LTH has also participated in a sell-off amid the last two rallies. So the recent distribution of LTHs is not necessarily a bad sign in the long term.

BTC Price

At the time of writing, Bitcoin is trading at around $61,200, down more than 4% from last week.

Looks like the price of the coin has been going down over the last few days | Source: BTCUSD on TradingView

Featured image of Dall-E, CryptoQuant.com, chart from TradingView.com