Richard Drury

Welcome to another edition of upcoming dividend increases. We are starting the July increases. If you are trading, please be aware of the modified market hours next week. The market will close at 1:00 PM EST on the 3rd and will be closed on The 4th of July. We also have dividend king Sysco Corporation extending its streak to 54 years with a 2% increase. The entire group of companies sees an average increase of 4.1% and a median of 3.7%.

My investment strategy is to buy, hold and add companies that meet two criteria: consistently increase their dividends and beat an equivalent benchmark. The information in this article is generated for my investment purposes and I am happy to share my findings with my Seeking Alpha audience. This list can help you make wise investment choices and create a successful long-term portfolio.

How I created the lists

The following information is the result of merging two data sources: a particular website’s “US Dividend Champions” spreadsheet and NASDAQ’s future dividend data. This process combines data from companies with a history of consistent dividend growth with future dividend payments. It is important to understand that all of the companies included in this list have consistently increased their dividends for at least five years.

Companies must pay higher total annual dividends to be included in this list. Therefore, a company cannot increase its dividend every calendar year, but the total annual dividend can still increase.

What is the ex-dividend date?

The ex-dividend date is the date you must hold shares to be eligible for an upcoming dividend or distribution. To qualify, you must have purchased the shares before the end of the previous business day. For example, if the ex-dividend date is a Tuesday, you must have acquired the shares before the market close on Monday. If the ex-dividend date falls on a Monday (or a Tuesday following a holiday Monday), you must have purchased the shares before the previous Friday.

Dividend Series Categories

Here are the definitions of the sequence categories, as I will use them throughout the article.

- King: 50+ years old.

- Champion/Aristocrat: 25+ years old.

- Candidate: 10-24 years old.

- Challenger: 5+ years.

| Category | Count |

| King | 1 |

| Champion | 1 |

| Competitor | 3 |

| Challenger | 0 |

List of dividend increases

The data was sorted by ex-dividend date (ascending) then by sequence (descending):

| Name | Teleprinter | Streak | Forward yield | Ex-div date | Increase percentage | Sequence Category |

| Cardinal Health, Inc. | (CAH) | 29 | 2 | July 1, 24 | 1.00% | Champion |

| Heico Company | (HE I) | 20 | 0.1 | 1-July-24 | 10.00% | Competitor |

| Simpson Manufacturing Company, Inc. | (SSD) | 11 | 0.66 | 3-Jul-24 | 3.70% | Competitor |

| Sysco Company | (SYY) | 54 | 2.82 | 5-July-24 | 2.00% | King |

| NetApp, Inc. | (NTAP) | ten | 1.56 | July 5, 2024 | 4.00% | Competitor |

Field Definitions

Streak: Years of dividend growth history comes from the US Dividend Champions spreadsheet.

Forward yield: The distribution rate is calculated by dividing the new distribution rate by the current stock price.

Ex-dividend date: This is the date by which you must own the stock.

Increase percentage: The percentage increase.

Sequence Category: This is the overall classification of the company’s dividend history.

Show me the money

Here is a table that shows the new and old rates as well as the percentage increase. The table is sorted by ex-dividend day in ascending order and by dividend sequence in descending order.

| Teleprinter | Old rate | New price | Increase percentage |

| CAH | 0.501 | 0.506 | 1.00% |

| HE I | 0.1 | 0.11 | 10.00% |

| SSD disk | 0.27 | 0.28 | 3.70% |

| SYY | 0.5 | 0.51 | 2.00% |

| NTAP | 0.5 | 0.52 | 4.00% |

Additional measures

Some different metrics related to these companies include year-over-year price change and price-to-earnings ratio. The table is sorted in the same way as the table above.

| Teleprinter | Current price | 52-week low | 52-week high | P/E Ratio | % off low | High % off |

| CAH | 101.09 | 83.83 | 115.52 | 16.75 | 21% Off Low Prices | 12% off premium products |

| HE I | 225.27 | 155.33 | 232.02 | 55.16 | 45% off low-end products | 3% off premium products |

| SSD | 169.03 | 123.59 | 218.08 | 9:48 p.m. | 37% off low-end products | 22% off top |

| SYY | 72.28 | 61.43 | 82.37 | 0 | 18% Off Low Prices | 12% off top |

| NTAP | 128.45 | 69.67 | 130.87 | 19.79 | 84% off bottoms | 2% off top |

Tickers by rate of return and growth

I’ve organized the table in descending order for investors who favor current yield. As a bonus, the table also shows some historical dividend growth rates. Additionally, I incorporated the “chowder rule,” which is the sum of the current yield and the five-year dividend growth rate.

| Teleprinter | Yield | 1 year DG | 3-year DG | 5 years CEO | 10 years DG | Chowder Rule |

| SYY | 2.82 | 35.4 | -4 | 6.3 | 5.8 | 9 |

| CAH | 2 | 1 | 1 | 1 | 5.2 | 3 |

| NTAP | 1.56 | 0 | 1.4 | 7.4 | 16.1 | 9 |

| SSD | 0.66 | 3.9 | -2.4 | 4.2 | 11.1 | 4.9 |

| HE I | 0.1 | 5.3 | 7.7 | 9 | 12.9 | 9.1 |

Historical returns

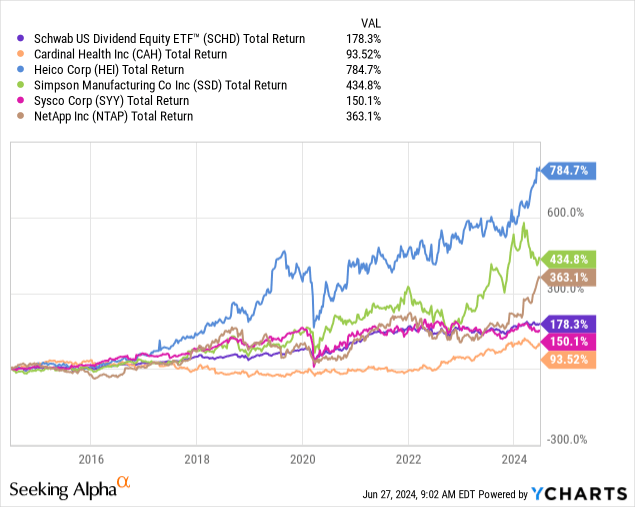

My investing approach is to identify stocks that consistently outperform the market while increasing dividend payouts. I use the Schwab US Dividend Equity ETF (SCHD) as a reference to evaluate performance. I use the “Cohen & Steers REIT & Preferred Income Fund” (RNP) for REITs. SCHD has a strong track record of exceptional performance, outperforms the S&P 500, and has consistently increased its dividends. I prefer to invest in ETF if a stock cannot outperform its benchmark index. I have selected several companies for my investment portfolio using this analysis. Additionally, I rely on this analysis to make additional purchases at the right time for my portfolio.

Ten-year dividend growth rate is one of the four main index factors behind SCHD. It is also an indicator of success, although it is not a perfect predictor. Stock prices tend to follow strong dividend growth over long periods of time. Here is a comparison between SCHD and those with ten-year dividend growth rates.

Over the past decade, SCHD has returned approximately 178% (dividends are reinvested in all of these results). There were three notable outperformers from this group: HEI (785%), SSD (435%), and NTAP (363%).

CAH and SYY lag behind SCHD, with CAH significantly underperforming with a total return of only 94%.

Next steps

After looking at the statistics and total return performance of each company, I’m really interested in taking a closer look at the top three performers. They each deserve a closer look because they outperformed SCHD. Since excellent passive options are available, individual businesses should be held to high standards.

The three companies have shown different levels of outperformance over time. HEI has been the clearest, beating the benchmark in 2017 and never falling below it since then. SSD follows a similar pattern to HEI, but their outperformance became much more visually clear after the March 2020 crash. Finally, NTAP’s performance has been more nuanced. Although she beat SCHD before 2020, she wandered for about four years until earlier this year, where she finally made a significant jump. These twists and turns give me pause, because their journey has not been as clear as that of an over-performing company.

I’ll take a closer look at them this week, compare them with my current holdings, and see if they deserve some of my dividend growth stocks. Let me know what you think of my strategy, and feel free to add yours in the comments below!

As always, please do your due diligence before making any investment decision.