pidjoe/E+ via Getty Images

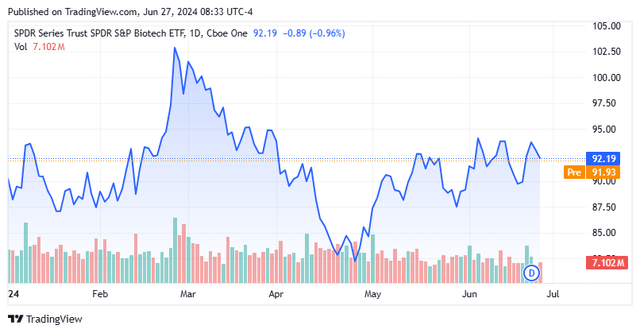

The small biotech sector has underperformed major indexes significantly so far in 2024. While the NASDAQ (COMP.IND) and S&P 500 (SP500) are both mid 1990s to present year, the SPDR® S&P Biotechnology ETF (XBI) up just over three percent by 2024. It is worth noting that the AI heavyweight Nvidia Company (NVDA) has accounted for about a third of the gains in the major indices since the start of the year.

The small biotech sector should perform better if the Federal Reserve cuts interest rates in the coming quarters, which historically helps high-beta sectors of the market. A pick-up in M&A volume across the sector could also provide a major boost to the sector if that happens. Today, we highlight three small-cap biotech names that look set to deliver strong results. shareholders in the second half of 2024. I have featured all of these companies in articles published this year. However, all of them have seen positive test data published after those articles were published.

Let’s start with Altimmune (ALT). I profiled this potential entrant into the massive and growing GLP-1 weight loss space in late May. On Wednesday, I significantly increased my ALT holdings via covered call orders as the stock fell about 15% in trading that day. The trigger for the decline was the untimely and unexpected situation the death of the company’s CEO. I’m willing to go out on a limb and say that this probably won’t have any long-term impact on the company’s development efforts.

In fact, there has been some good news on the trial development front recently. On Monday of this week, Altimmune released Phase 2 study results data around its main candidate against obesity, pemvidutide recorded an average weight loss of 15.6% at 48 weeks of its study from the highest of the three doses evaluated. It is important to note that weight loss came to a lesser extent from lean muscle mass than from Wegovy’s GLP-1 blockbuster drugs. Novo Nordisk (NVO) Or That of Eli Lilly (THERE IS) Linked by Zep.

Company presentation in November

A few days before the publication of this data, B. Riley Financial reissued his Buy rating and $20 price target on ALT. Riley’s analyst noted

‘Recent presentations at ADA’24 highlighted compelling Phase IIb data for Altimmune’s lead candidate, pemvidutide, suggesting strong therapeutic potential in the obesity landscape. Notably, the drug demonstrated preservation of lean mass during weight loss, a significant differentiator compared to its competitors, as well as notable reductions in LDL-C and triglycerides, demonstrating its lipid-lowering efficacy. In addition, the proportion of non-responders was low, indicating the drug’s significant potency in inducing weight loss..’

He was also impressed by ““favorable impact on blood pressure and a balanced HbA1c profile” as well as the compound’s ability to potentially differentiate itself in the GLP-1 market. With Altimmune’s market cap below $500 million, the stock is an attractive buyout target given the enormous interest in the burgeoning GLP-1 sector.

then, we have Intellia Therapeutics (NTLA)a promising concern in clinical-stage gene therapy. I last posted a article around Intellia Therapeutics in late February here on Seeking Alpha. Earlier this month, the company reported an impressive Phase 1 results around its candidate for hereditary angioedema, or HAE. Data showed that a single dose of NTLA-2002 resulted in an average 98% reduction in monthly attack rate. Eight of the ten patients in the trial were seizure-free after a 16-week primary observation period until the final study follow-up. It should be noted that these were patients with the most extreme version of this rare condition.

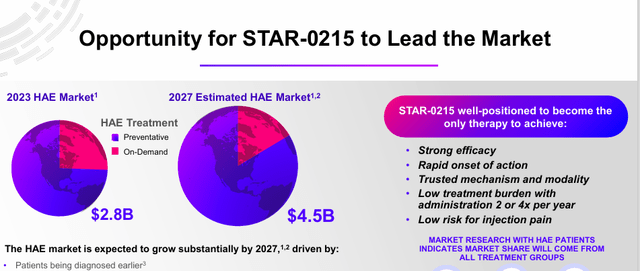

Additionally, some Phase 2 results evaluating NTLA-2002 are expected to be released this summer. If all goes well, a pivotal phase 3 trial should start by the end of this year. FDA approval could follow sometime in 2027. It is important to note that HAE is a large and growing market.

Astria Therapeutics Company Presentation in June 2024

Several approved drugs are on the market to treat this disease, including the market-leading drug Takhzyro of Takeda (TAKE) which had revenue of approximately $1.14 billion in fiscal 2022. Several other companies are pursuing potentially more effective treatments in clinical development. However, if NTLA-2002 is successful, it will not be a “treatment” but a potential one-time curative dose for the disease and is therefore expected to dominate the market. Since the data from this study was released just over three weeks ago, 10 analyst firms, including Wells Fargo, BMO Capital, and Stifel Nicolaus, have reissued/assigned Buy ratings on the stock. Suggested price targets range from $24 to $95 per share, with most price targets in the $57 to $73 per share range. NTLA is currently trading in the low $20s.

Finally, we have Mirum Pharmaceuticals (MIRM) that I last Underlines here on these pages at the beginning of March. The company is moving forward on two key fronts. First, its drug Livmarli, an oral solution approved for the treatment of cholestatic pruritus in patients with Alagille syndrome, is showing more than solid commercial traction. This rare condition affects an estimated 30,000 to 40,000 people in the United States. This compound was approved in the United States in 2021 and in Europe shortly after in 2022.

Livmarli reported net sales of $68.9 million in the first quarter, which Mirum reported may’s beginning. This is an increase of 137% compared to the same period last year, and management estimated that Livmarli should achieve between $310 million and $320 million in net sales in fiscal 2024. Two weeks ago, Mirum announced a strong phase 2b results Around it is the pipeline’s main asset, Volixibat. This compound is an oral ileal bile acid transporter inhibitor that Mirum is evaluating to treat primary sclerosing cholangitis and primary biliary cholangitis. Data showed that 75% of patients taking volixibat achieved greater than a 50% reduction in serum bile acids. The compound also had good safety and tolerability ratings.

This research news sent the stock up about 20% last week. The new data also prompted four analyst firms, including JP Morgan and Morgan Stanley, to reissue Buy ratings on the stock. It is worth noting that three of these Buy reiterations included significant upward revisions to their price targets. The new price targets offered range from $39 to $66 per share. MIRM is currently trading around $30, even after last week’s stock rally.

Mirum Pharmaceuticals currently has a market capitalization of just over $1.5 billion and is not expected to need to raise additional capital as the company is expected to break even or become profitable for the first time within fiscal year 2025. In late May, Wells Fargo placed the company on its potential for acquisition by a biotechnology/biopharmaceutical company list Also.

And these are three small-cap biotech names with encouraging recent trial news and that appear poised for a strong second half of 2024, especially if sentiment on the small-cap sector improves in the coming months.